10x Derivatives Edge: Bitcoin Volatility/Options Play

Actionable Market Insights

Why this report matters

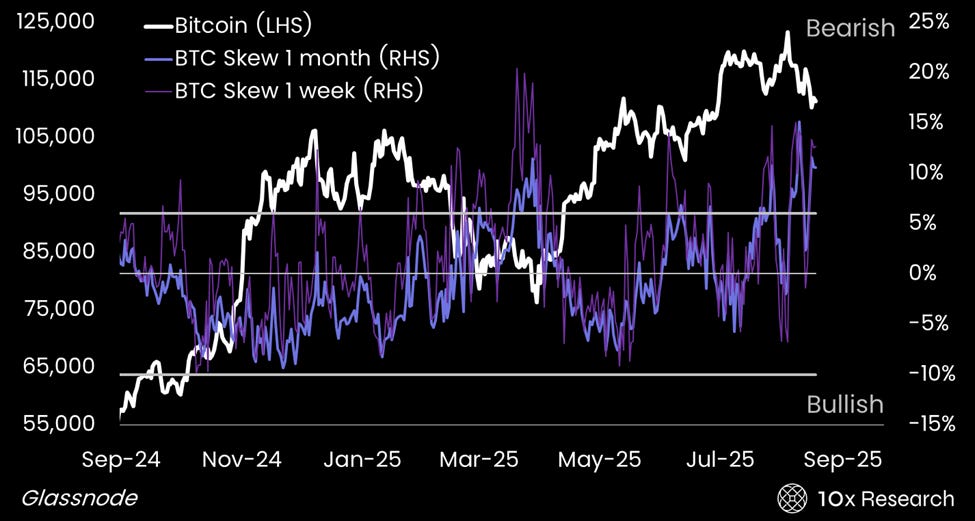

Bitcoin’s options market is flashing signals that traders can’t afford to ignore. Implied volatility has risen above realized volatility, skew has flipped sharply bearish, and the term structure points to heightened uncertainty into September. Yet despite this cautious positioning, Bitcoin continues to hold within a well-defined range. That tension between elevated hedging demand and muted price action sets the stage for a powerful trade setup.

The question is whether traders should buy protection alongside the crowd—or sell it while premiums remain inflated. This month’s play may reveal where the real edge lies in Bitcoin volatility.

Bitcoin (LHS) vs. BTC Skew (RHS)