10x Weekly Crypto Kickoff – $1.5 billion in Crypto ETF outflows and traders paying up for protection

The Week Ahead in Crypto Markets

Why this report matters

Bitcoin’s sharp pullback has shaken leveraged traders, but derivatives markets are quietly revealing a more complex story beneath the surface. Funding rates have reset, volatility has spiked, and option traders are positioning for something bigger than just a short-term bounce. Ethereum, meanwhile, exhibits a curious divergence—its skew has shifted more bearish at the front end, even as long-term traders continue to buy calls.

Stablecoin inflows remain steady, but liquidity trends suggest the next directional move could be faster and sharper than most expect. With sentiment collapsing into extreme fear and realized volatility nearing cycle highs, smart money is already preparing for what comes next. This week’s report breaks down what option flows, positioning data, sentiment, leverage, potential BTC and ETF range, and volatility structures are signaling about the next major move in crypto.

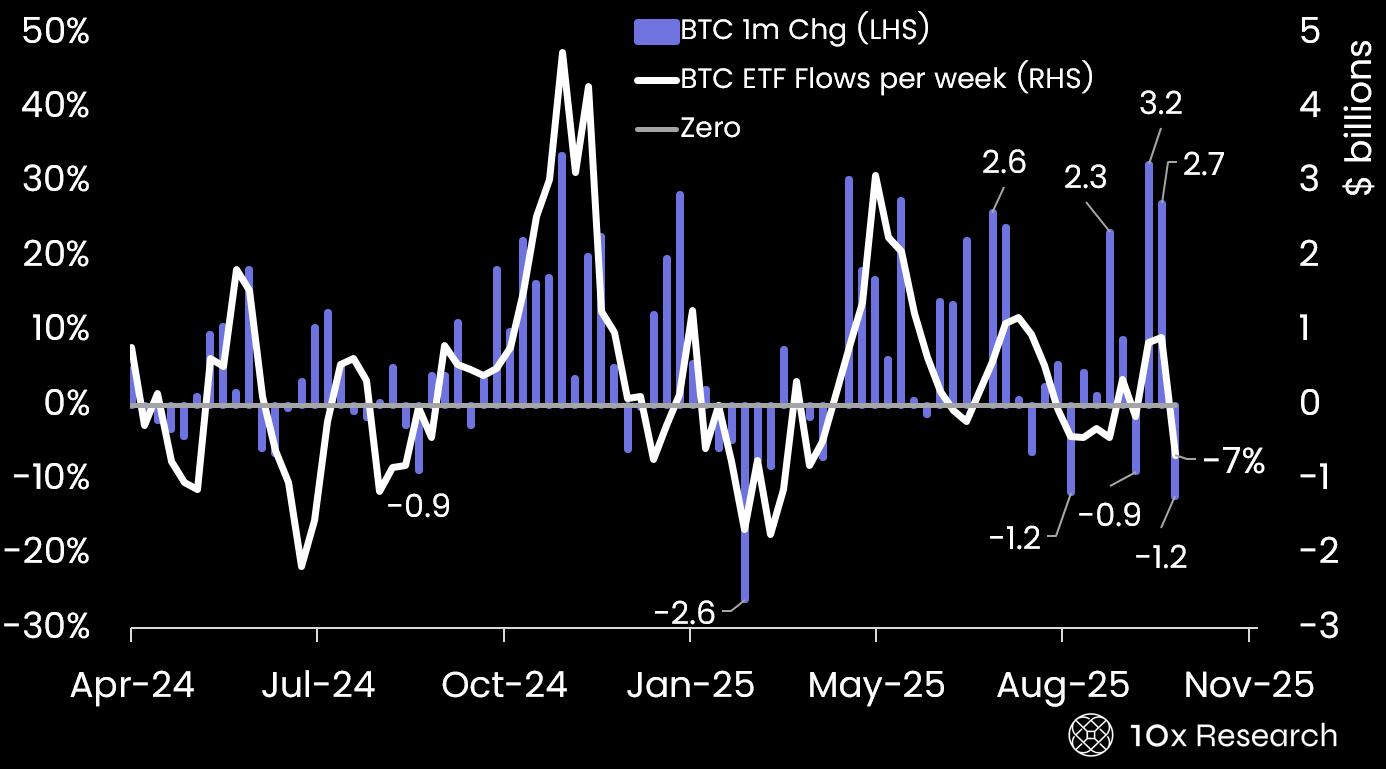

Bitcoin ETF Flows saw $1.2 billion outflows last week