10x Weekly Crypto Kickoff – Calm Markets, Fragile Positioning Ahead of Key Catalysts

The Week Ahead in Crypto Markets

10x Weekly Crypto Kickoff – Calm Markets, Fragile Positioning Ahead of Key Catalysts

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges for the next 1–2 weeks, and key upcoming market catalysts.

Why this report matters

Crypto markets look calm, but positioning beneath the surface is anything but.

This week brings a dense cluster of high-impact catalysts, spanning macro data, regulation, and major protocol upgrades, at a time when liquidity is thinning and conviction is fragile. While spot prices suggest stability, derivatives, funding, volatility, and flows tell a very different story.

This is typically when experienced traders reposition quietly, using compressed volatility and complacent markets to adjust risk ahead of potential regime shifts. Missing these signals can be costly, especially when positioning, not headlines, drives the next move.

Our latest 10x Weekly Crypto Kickoff breaks down how traders are positioned, where exposure is being added or unwound, and what the market is implicitly pricing in for the week ahead.

Read the full report to be prepared, not reactive.

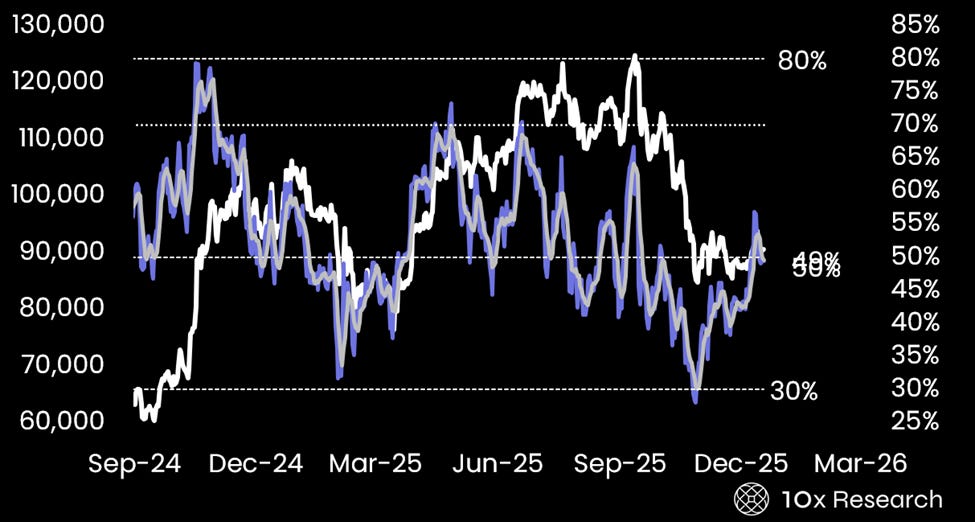

BTC technicals (RSI) are lackluster, despite a bullish trend signal