10x Weekly Crypto Kickoff – This Market Is Leaving Hesitant Traders Behind

The Week Ahead in Crypto Markets

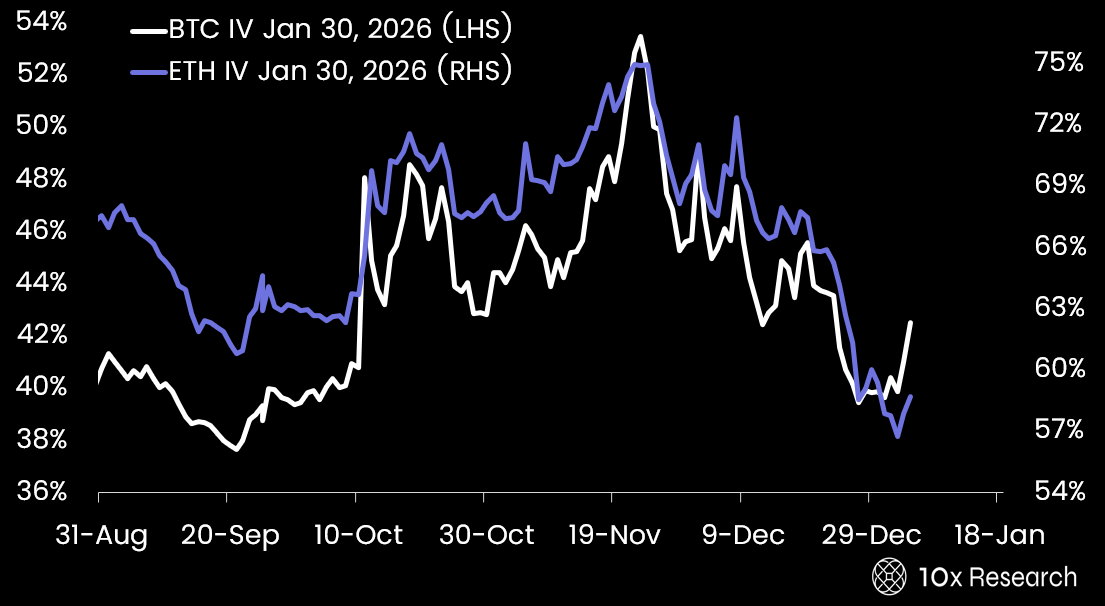

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges for the next 1–2 weeks, and key upcoming market catalysts.

Why this report matters

Most traders are reacting to price. A few are watching positioning.

Almost no one is connecting flows, derivatives, volatility, sentiment, technicals, and structure simultaneously. Right now, Bitcoin and Ethereum are doing something that looks familiar, but the underlying signals are very different from what most expect. Some data points are improving quickly, others are lagging, and a few are flashing warnings that rarely appear together.

This is precisely the type of environment where doing nothing feels safe… and turns out to be the real risk. The question isn’t “bullish or bearish.”

It’s where risk is actually building, and where traders are quietly positioning ahead of the next move. We laid it all out in this week’s 10x Research Market Update—from ETF and options flows to volatility regimes, trend signals, and what matters over the next 1–2 weeks.

What does the option market tell us about Bitcoin’s next move?