10x Weekly Crypto Kickoff – When Liquidity Vanishes, Positioning Decides the Next Move

The Week Ahead in Crypto Markets

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges for the next 1–2 weeks, and key upcoming market catalysts.

Why this report matters

Crypto markets are entering the new year with activity at cycle lows, yet derivatives positioning is quietly sending a very different signal. Volatility is compressing, funding is drifting higher, and leverage remains somewhat elevated, even as volumes and participation continue to fade. ETF flows, stablecoin activity, and futures positioning are no longer aligned, creating a market that looks calm on the surface but increasingly fragile underneath.

Options markets are adjusting in ways that typically precede regime shifts rather than trend continuation. At the same time, technical indicators are approaching levels where small moves can trigger larger reallocations.

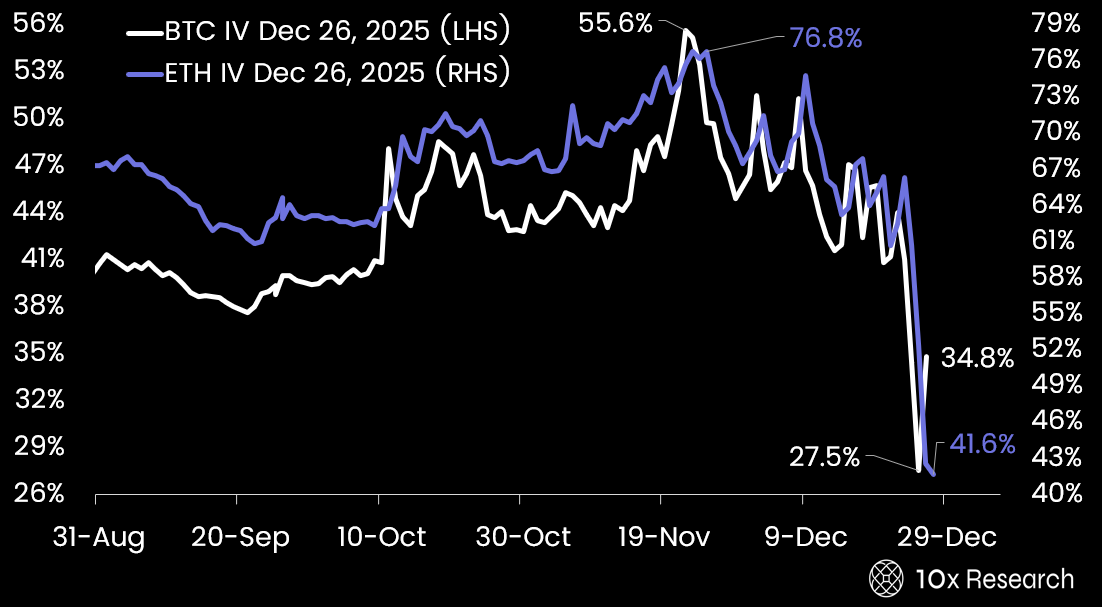

Bitcoin and Ethereum Implied Volatility collapsed into year end.