10x Weekly Crypto Kickoff – Why Year-End Risk Skews to the Downside

The Week Ahead in Crypto Markets

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges for the next 1–2 weeks, and key upcoming market catalysts.

Why this report matters

As crypto markets drift into year-end, volatility is compressing just as liquidity and participation fade, creating a fragile setup beneath the surface. Bitcoin and Ethereum derivatives positioning indicates traders are de-risking short-term exposure while maintaining defensive structures rather than chasing upside. ETF flows, stablecoin issuance, and futures positioning all point to the same conclusion: without fresh inflows, rallies struggle to sustain.

Options markets are increasingly pricing range-bound outcomes, but with asymmetry skewed toward downside risk if support levels fail. Historical patterns around Fed pauses and rate-cut cycles suggest the current weakness is not an anomaly, but a familiar phase of the cycle. The post-FOMC meeting pattern and our view from last week’s Kickoff report (here) are playing out as expected.

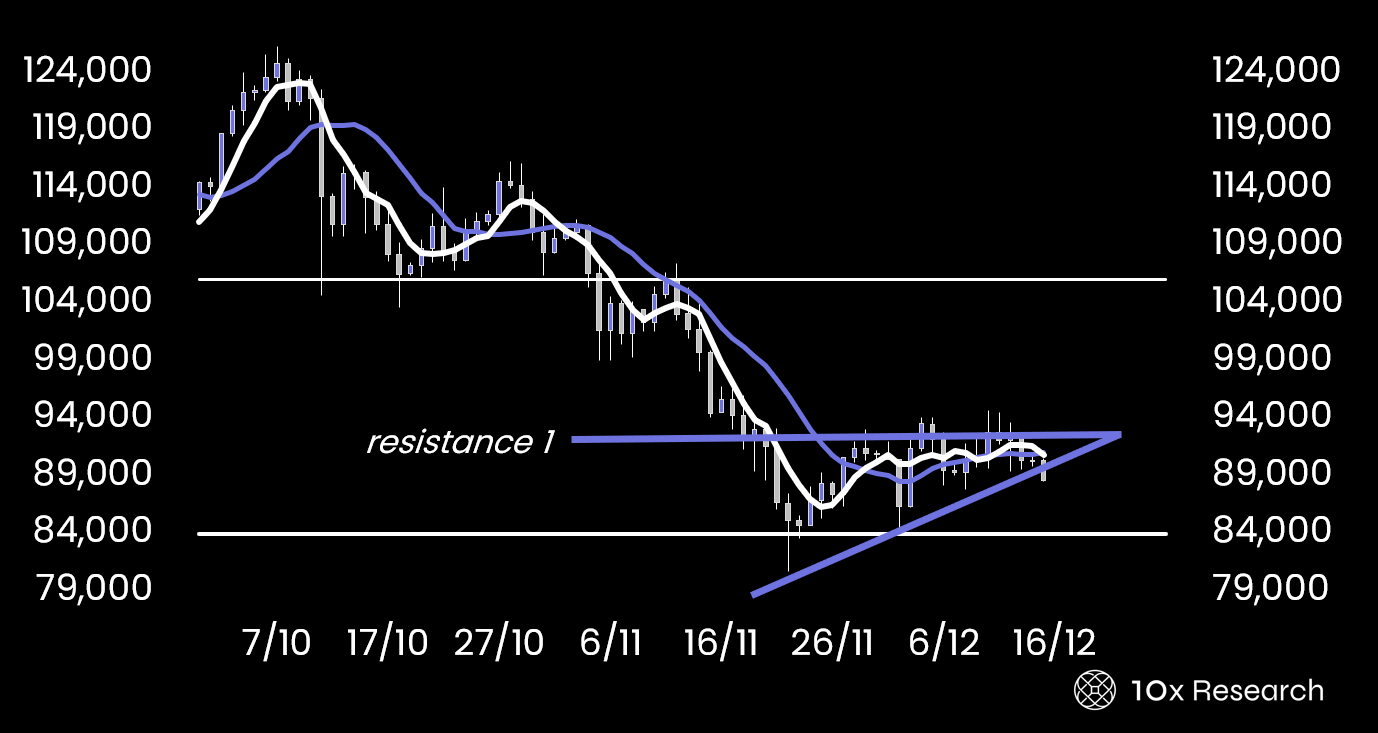

Bitcoin is breaking the triangle support