10x Weekly Crypto Kickoff – Year-End Calm or the Setup for 2026?

The Week Ahead in Crypto Markets

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges for the next 1–2 weeks, and key upcoming market catalysts.

Why this report matters

Year-end liquidity is evaporating across crypto markets, but the implications go well beyond quiet holiday trading. Futures positioning, ETF flows, and option markets are sending a coordinated signal about how traders are de-risking into year-end. Volatility is compressing rapidly, yet derivatives pricing suggests this calm may be temporary rather than benign. Bitcoin and Ethereum are hovering near critical levels where positioning shifts, not headlines, could drive the next move. With leverage unwinding, stablecoin flows weakening, and skew dynamics quietly improving, the risk-reward profile is changing in subtle but important ways.

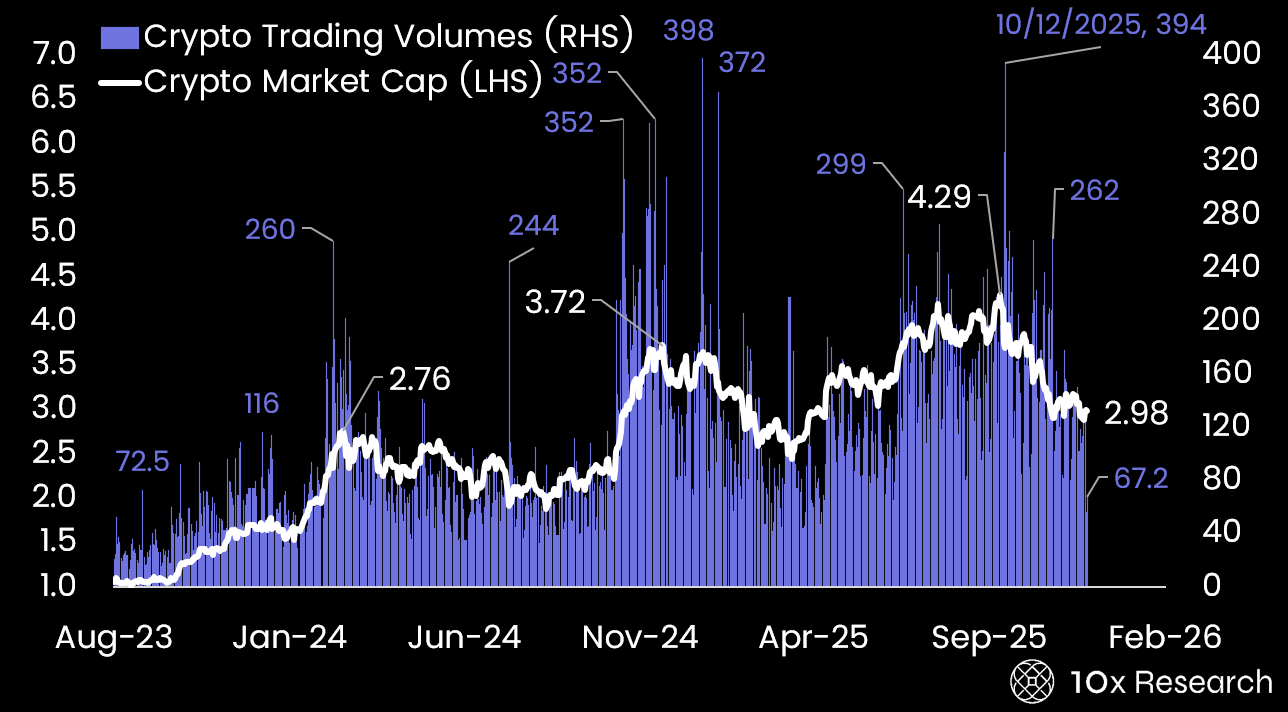

Crypto Market Cap ($2.98 trillion) vs. Trading Volumes ($67.2 billion)