2 Urgent Bitcoin Trades with Big Upside—If You Act Fast

Actionable Market Insights

Why this report matters

Markets are flashing signals that the next move could be decisive. Options traders are paying up for downside protection, but technicals suggest the picture may not be so one-sided. Treasury yields are breaking lower, rate cuts are now priced in, and the Fed faces its most pivotal test of the year. Bitcoin is hanging onto the $106,000–108,000 support zone—will it hold or finally crack? Two highly asymmetric trades could define the next big move. With catalysts stacking up fast, timing isn’t just important—it’s everything.

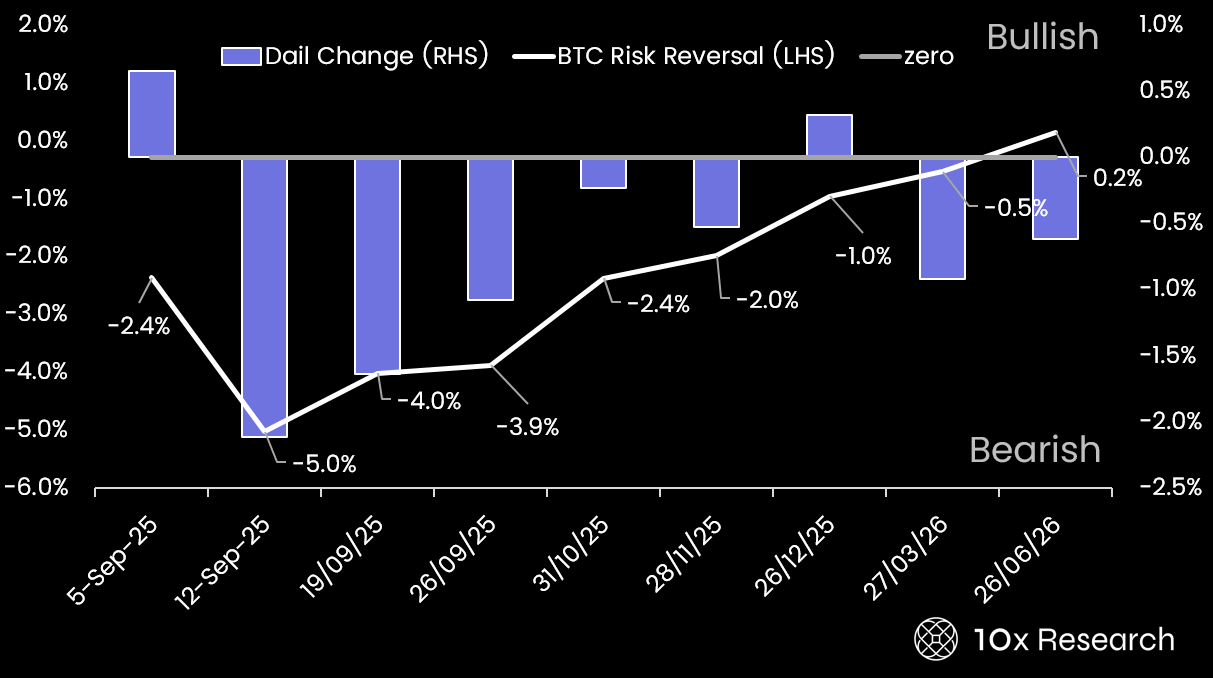

Bitcoin Option traders are very bearish. Are they right?

Main argument

The Bitcoin options market (sign up or see pricing here) is flashing clear warning signs: traders are pricing in event-driven downside risk, likely tied to the upcoming U.S. jobs data, BLS revisions, CPI, and the September 17 FOMC. Skew is deeply negative, with near-term expiries (Sep 6 and Sep 12) sitting at –4.3%, reflecting heavy demand for puts over calls. This tilt means traders are paying up for downside protection, fearing a sharp drop. But what does this mean historically? And what are trades?