After Being Bearish, This Is the Day, and the Exact Hour, We Will Buy Bitcoin

Actionable Market Insights

Why this report matters

Bitcoin has been under heavy pressure, with volatility compressing, leverage retreating, and risk appetite conspicuously absent after the October shock. We have been bearish since October 22 (here). Yet beneath the surface, positioning across derivatives, ETFs, and technical indicators is beginning to shift. The largest Bitcoin options expiry on record is approaching, with strikes and open interest revealing where stress and opportunity may be building.

At the same time, past year-end patterns suggest that periods of extreme caution can quietly give way to sharp sentiment reversals once calendars and risk budgets reset. Technical conditions are also evolving, hinting that the balance between downside exhaustion and upside optionality is becoming more nuanced.

Main arguments

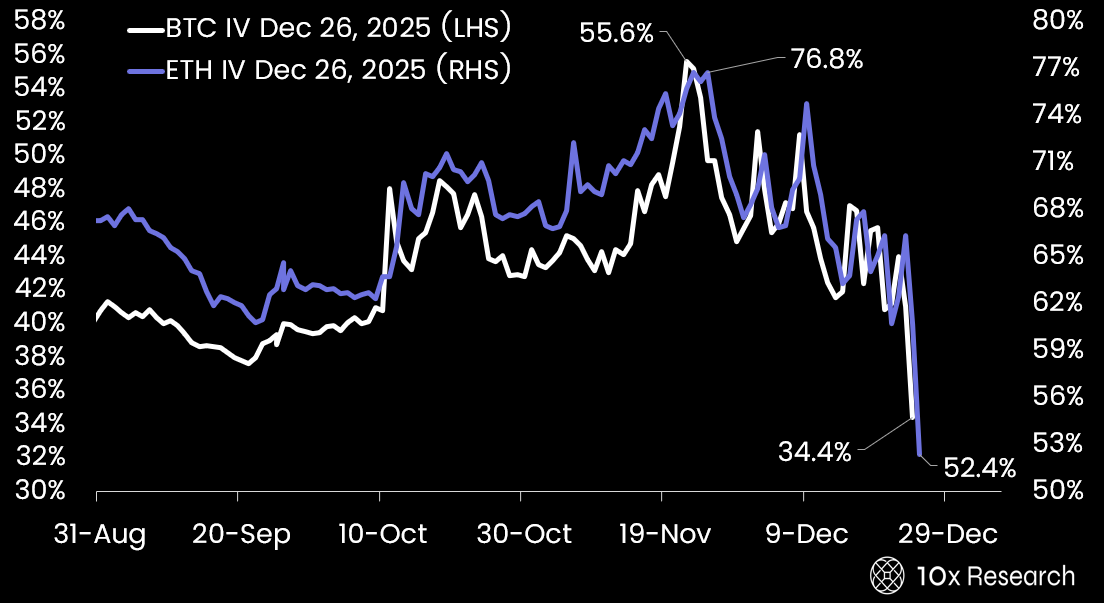

One of our highest-conviction views in November was that Bitcoin’s implied volatility would compress into year-end, as prices were likely to remain range-bound between $70,000 and $100,000. With few near-term catalysts and a Federal Reserve expected to be less dovish than markets had hoped, upside momentum appeared limited. We also argued that Bitcoin, having underperformed other major assets, was particularly vulnerable to tax-loss selling by multi-asset investors looking to offset gains elsewhere.

Bitcoin and Ethereum Implied Volatility is collapsing