After Crypto’s October 10 Crash: Are We Entering the Final Stage of Deleveraging?

Actionable Market Insights

Why this report matters

October proved to be the most consequential month for Bitcoin in 2025, marking the point at which the bull market decisively turned bearish amid a convergence of overlapping shocks. Understanding what happened during this period is critical because it challenges the long-held assumption that dollar-cost averaging is always a viable strategy in crypto. Even MicroStrategy’s roughly $58 billion Bitcoin accumulation, built steadily since August 2020, now sits only about 16% above its average cost basis, underscoring how limited upside can become once cycle dynamics turn.

Bitcoin / Crypto crashed on October 10, erasing $1.3 trillion in market value

Today, Bitcoin investors must go far beyond macro narratives and inflation hedges: success increasingly depends on grasping monetary policy expectations, institutional flows, on-chain behavior, moving-average regime shifts, and, crucially, market structure. History shows that each cycle is ultimately broken not by what is well understood, but by something new and insufficiently battle-tested. In this case, the fragile interaction among Binance, Ethena, and Hyperliquid snapped on October 10, derailing the market’s momentum, and, unlike previous setbacks, the market failed to recover.

Main arguments

Crypto markets broke sharply on October 10, and the damage since then has been substantial. In the weeks that followed, crypto investors saw roughly $1.3 trillion in market value erased, equivalent to nearly 30% of total capitalization. Binance’s insurance fund absorbed an unprecedented $184 million loss as liquidation engines struggled to match bids and offers during extreme volatility. At the same time, Hyperliquid accounted for roughly 53% of all liquidations, highlighting the degree of concentrated leverage and speculative excess in parts of the market. Ethena’s USDe stablecoin experienced $8.3 billion in net outflows, reflecting a sharp loss of confidence in synthetic collateral during stress.

Since the crash, overall crypto trading volumes have fallen by about 50%, a clear sign that many traders and market makers have stepped back. Since late October, Bitcoin ETFs have experienced $5 billion in net outflows, indicating sustained selling pressure from institutional and regulated investors. Bitcoin traded consistently at a discount on Coinbase, a venue dominated by U.S.-based and compliance-focused participants.

Together, these dynamics suggest that U.S. institutional investors have been systematically de-grossing risk, reducing exposure. This pattern reinforces the view that recent weakness has been driven less by speculative capitulation and more by a deliberate pullback from regulated capital. This retreat in leverage and liquidity helps explain why Bitcoin has decoupled from both equities and gold since October, trading more as an isolated, de-risking asset than as a macro beta or inflation hedge.

On October 10/11, Bitcoin fell 14% in a matter of minutes. Crypto exchanges, especially derivatives-heavy platforms like Binance, tend to be structurally profitable during periods of heavy liquidations because of how leverage, fees, and liquidation mechanics are designed. When traders use leverage, they pay funding rates, trading fees, and liquidation fees. During volatile moves, forced liquidations trigger a cascade of market orders, dramatically increasing trading volume and widening the bid/offer spreads, exactly the environment where exchanges earn the most. Even when traders lose, the exchange still collects fees on both the opening and forced closing of positions, meaning sharp market moves often translate into record revenue for the venue itself.

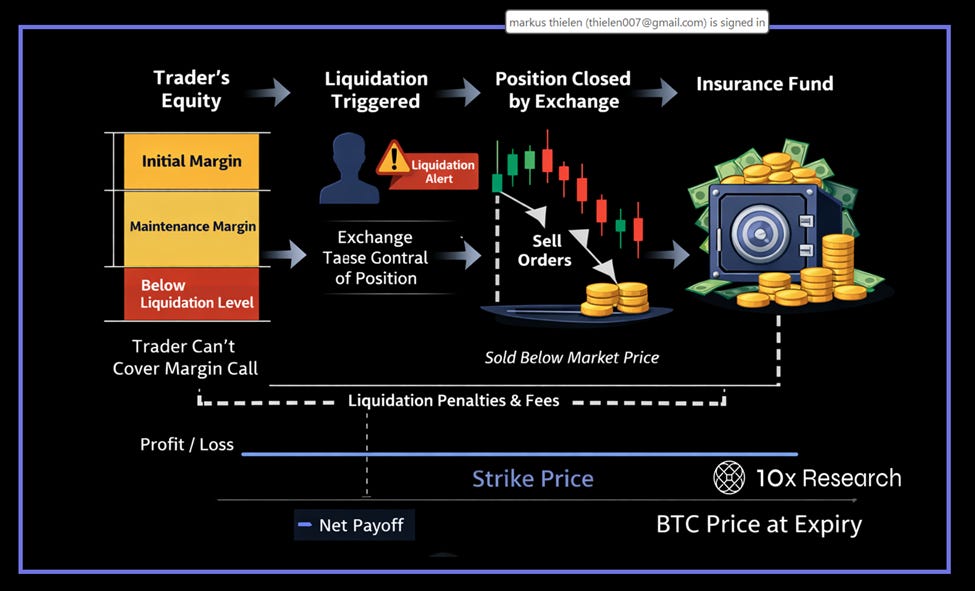

Beyond fees, liquidation engines are designed to close positions before they become insolvent, usually at prices that still protect the exchange. On Binance (and most other exchanges), this risk is further backstopped by an insurance fund, which is capital set aside to absorb losses if a liquidated position cannot be closed at a price sufficient to cover the trader’s debt. As long as liquidations are orderly, the insurance fund typically grows over time, particularly in volatile markets, because liquidation penalties and fees are remitted to it.

Traders post an initial margin to open a position, but must maintain a lower maintenance margin to keep it open. Liquidations are triggered before a trader’s equity is wiped out, giving the exchange a built-in safety buffer. Once liquidation occurs, the exchange takes control of the position and closes it using aggressive orders, often at prices worse than fair market value. The difference between the liquidation price and the actual close, combined with explicit liquidation penalties and taker fees, creates an implicit spread that is captured by the exchange or funneled into its insurance fund.

Crypto exchanges make most of their money during liquidations