Are Bitcoin and Altcoin Rallies Engineered? And Is the Next Major Catalyst Approaching?

Actionable Market Insights

Why this report matters

For years, many retail-focused crypto commentators have confidently predicted that an altcoin rally would emerge “out of nowhere.” Catchy labels like the “banana zone” made for great headlines, but in practice, calling altcoin rallies in advance has become notoriously difficult. It is not simply a function of liquidity, stock-to-flow narratives, or spillovers from zero-day options activity in equity markets. In part, this reflects the fact that Bitcoin now spends far less time in sustained uptrends, meaning that simple strategies like dollar-cost averaging or remaining permanently long are no longer as effective as they once were.

There is, however, a different data point that has historically provided far more reliable insight into when altcoin rallies are likely to begin, and, more importantly, when they are close to peaking. Recently, several altcoins have started to form constructive technical patterns, suggesting a potential shift. The Trump tariff curveball has since disrupted those setups, raising the key question: Is this merely a temporary setback within a broader altcoin rally, or is it the signal that the window is once again closing? However, another catalyst is approaching, one that has historically been far more reliable, and recognizing it early may be the difference between catching the next wave and being the last buyer chasing the pump.

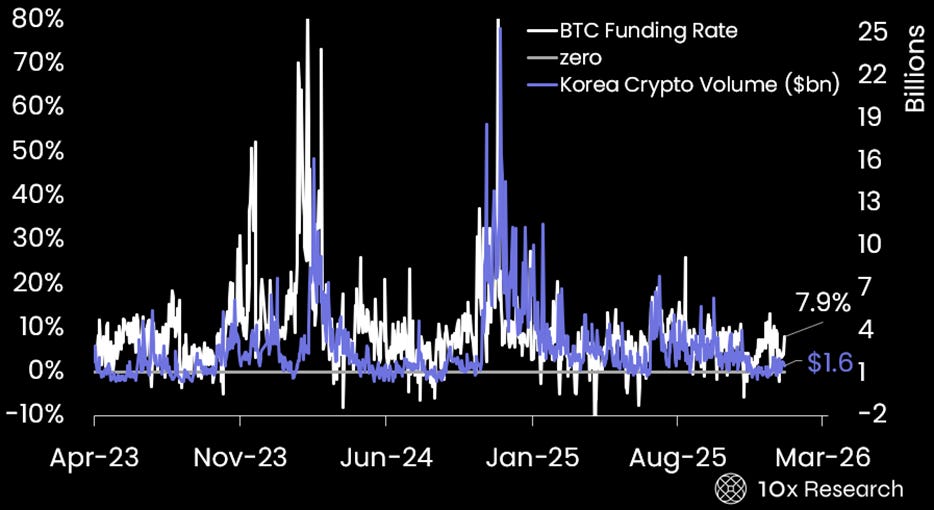

BTC Funding Rate is rising (LHS) vs. Korea [retail] crypto volumes (RHS)