Are Hedge Funds Targeting MicroStrategy as Its Largest Holder Trims? And What’s the Trade?

Actionable Market Insights

Why this report matters

MicroStrategy has been stuck in one of the tightest trading ranges in years, with its $360 support level tested again and again. But now, with its largest shareholder quietly trimming and hedge funds stepping in, the next move could prove decisive. Bitcoin treasuries as a group are losing their edge, just as Ethereum treasuries and new crypto IPOs begin to draw fresh capital.

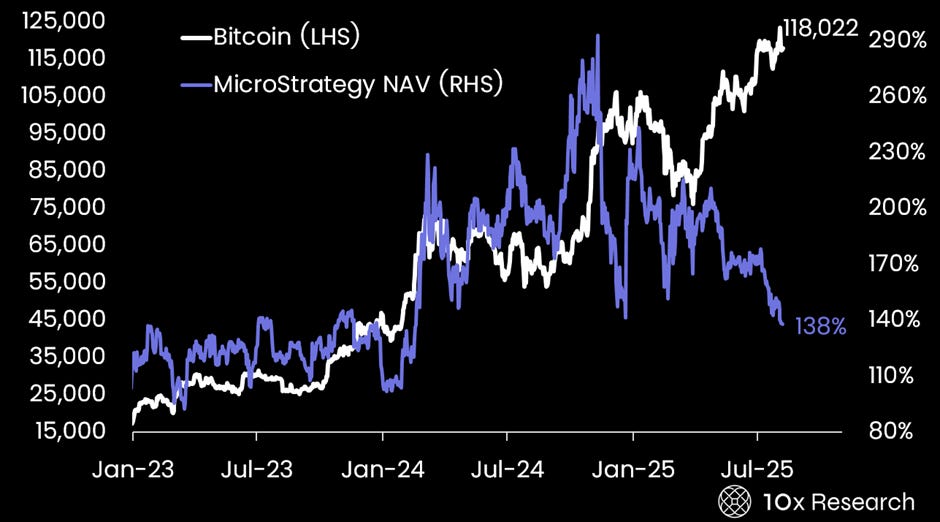

Bitcoin (LHS) vs. MicroStrategy’s Net Asset Value (RHS)

Meanwhile, declining volatility across Bitcoin and MicroStrategy is reshaping how investors think about convexity, risk, and opportunity. The question is whether this breakdown, or breakout, becomes the signal for broader sentiment on Bitcoin itself.

Main argument

Volatility in MicroStrategy shares has collapsed, with the stock locked in a tight range for the past four months. The $360 level has repeatedly served as key support, holding firm through several retests—but the question is whether it can hold again. Notably, MicroStrategy’s largest shareholder, Vanguard, trimmed its position by 10% last quarter. While some long-only investors stepped in to accumulate, hedge funds now dominate trading activity, making this technical level especially important.

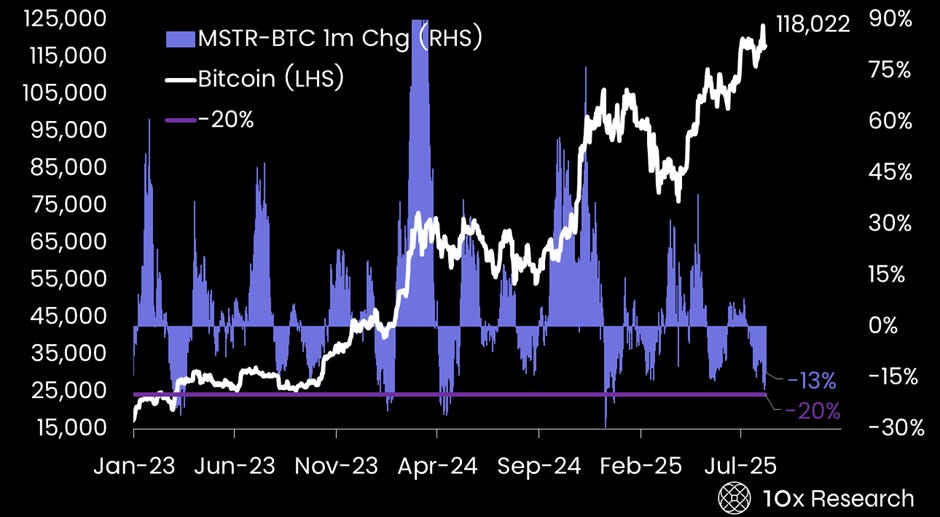

Bitcoin (LHS) vs. 1 month return BTC vs. MicroStrategy (RHS)

Historically, when MicroStrategy has lagged Bitcoin by 20% over one month, it has marked an attractive risk/reward entry point. However, the next decisive move will be critical—not only for MicroStrategy, but also for broader Bitcoin sentiment.

In our July 19, 2025, report, “Has MicroStrategy Lost Its Convexity Edge Over Bitcoin?” we argued that as volatility in both Bitcoin and MicroStrategy declined, the company’s ability to amplify Bitcoin’s upside would diminish. Lower volatility meant its NAV would track Bitcoin more closely, reducing the scope for premium-driven capital raises. We highlighted that Metaplanet faced the same dynamic, with fresh investment flows likely to dry up.

Since then, the market has validated our view: MicroStrategy shares have slipped to $366 (-13%), while Metaplanet has dropped to $1,333 (-37%), with both losing their once-compelling edge over Bitcoin itself. Bitcoin treasury companies have faced growing competition from Ethereum treasuries and newly listed crypto stocks.

Our major call, that Bitcoin volatility would decline sharply over the summer, eroding the NAV premium of these Bitcoin treasuries with declining share prices, is now playing out. The key question for investors is when to re-enter: should the trigger be a specific price level, or does it depend on broader conditions?