Bitcoin: A Smash Move Is Coming

Empowering Traders with Insights

We now include a conclusion at the end of each report to help readers quickly grasp the key takeaways and core message.

Topics: Bitcoin on-chain, liquidity, money flow, ETF flow

Conclusion and Trading View: see end of this report👇1-13) In our February 4 report, with Bitcoin trading near $100,000, we identified a Diamond Top pattern formation and warned of an impending correction. A break below the critical $95,000 support — our key technical trigger — confirmed the pattern.

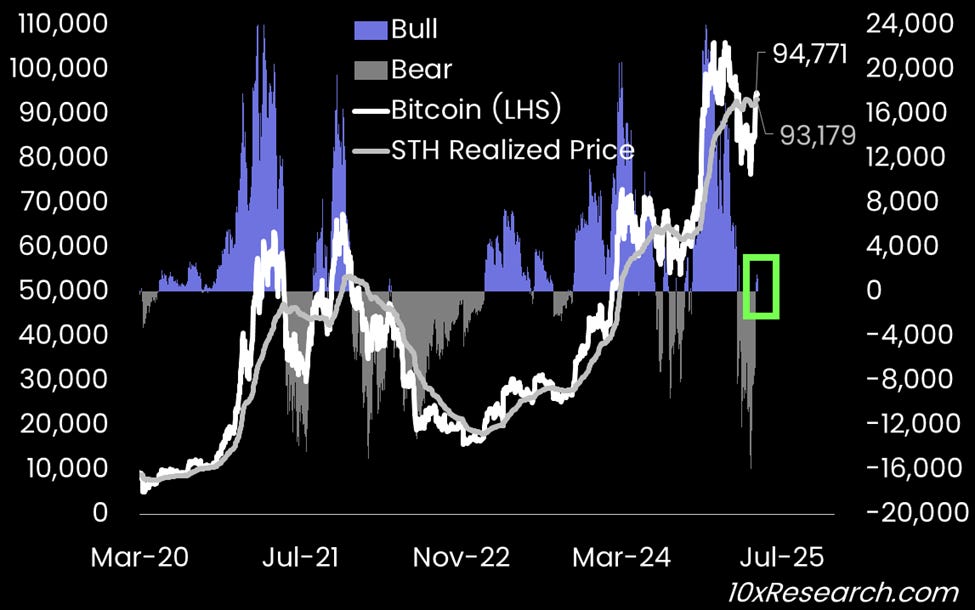

👇2-13) By February 25, Bitcoin had not only breached $95,000 but also the short-term holder realized price, triggering a wave of liquidations. As the technical structure shifted into an ascending broadening wedge, we outlined further downside risk with a target of $73,000. Bitcoin ultimately fell to $74,400, within less than $1,400 of our projected level.

Bitcoin Short-Term Realized Price - Liquidations in February/March

👇3-13) By April 13, with Bitcoin trading at $85,322, we shifted back to a bullish stance. Although we did not capture the exact low, the technical setup pointed clearly to a +10% rally. Having been vocal bears at $95,000 — and bulls from $85,000 — our alpha over Bitcoin during the past two months reached +11%. Consistently compounding such outperformance is critical, particularly by cutting off the left-tail risks that have historically challenged Bitcoin investors. This underscores the value of these Market Updates, driven by market structure, on-chain data, technicals, and sentiment analysis.

👇4-13) Bitcoin has rallied back to the $94,000–$95,000 zone — exactly where we expected (see our video) — but has stalled at this critical resistance. We warned that for Bitcoin to break meaningfully higher, we would need to see decisive improvements across key market structure signals: trading volumes, stablecoin minting, implied volatility shifts, and broader liquidity flows. The real question now: have these crucial indicators turned enough to unleash a fresh breakout — or has the technical rebound already peaked, setting Bitcoin up for a sharp reversal as macro and tariff risks escalate?