Bitcoin and Tariffs: How to Position for What Comes Next

Institutional Crypto Research Written by Experts

Topics covered: bitcoin, tariffs, on-chain, altcoins, trend, Fed, ISMViews: short-term, medium term, trading strategy/expectation around tariffs for bitcoin👇1-16) Several key trends are unfolding in the cryptocurrency markets, and it’s important to clarify them. While we frequently provide updates, we want to be more explicit about whether our reports are short-term (1–4 weeks) or medium-term (1–6 months) in focus. Generally, on-chain data tends to support medium-term outlooks, whereas reversal indicators and tactical setups are typically short-term in nature. Some subscribers prefer medium-term outlooks and broader market perspectives, while others are more focused on our day-to-day trading insights and short-term analysis.

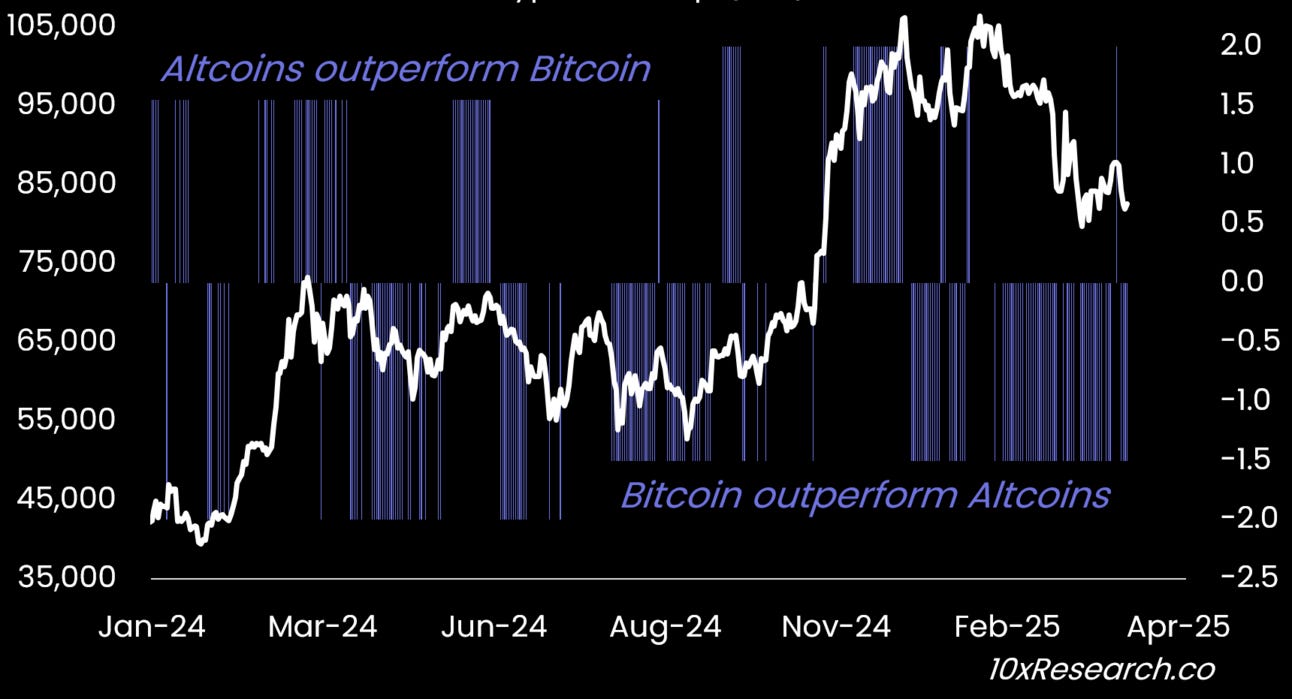

Bitcoin expected to outperform Altcoins based on our model

👇2-16) The longer the time horizon, the less emphasis we place on stop-losses, as the upside potential can absorb short-term volatility. However, if we identify a short-term bullish setup within a medium-term bearish view, tight risk management—or avoiding the trade altogether—is critical. This also requires closely monitoring for shifts in market narrative and watching closely if key stop levels are breached.