Bitcoin and the Fed: Breakout Catalyst or Sell-the-News Trap?

Actionable Market Insights

Why this report matters

Bitcoin is up +24% year-to-date, yet many traders remain frustrated by its irregular rhythm—price surges seem to arrive in bursts rather than from a steady retail bid. Unlike equities, which are up 12–16% with a higher Sharpe ratio driven by persistent long-only flows, crypto moves hinge on catalysts. That’s why identifying events that can trigger sharp upside repricing is critical. With the Fed meeting this week, some expect another breakout, while others fear a sell-the-news scenario. Our take is different—and we outline it below.

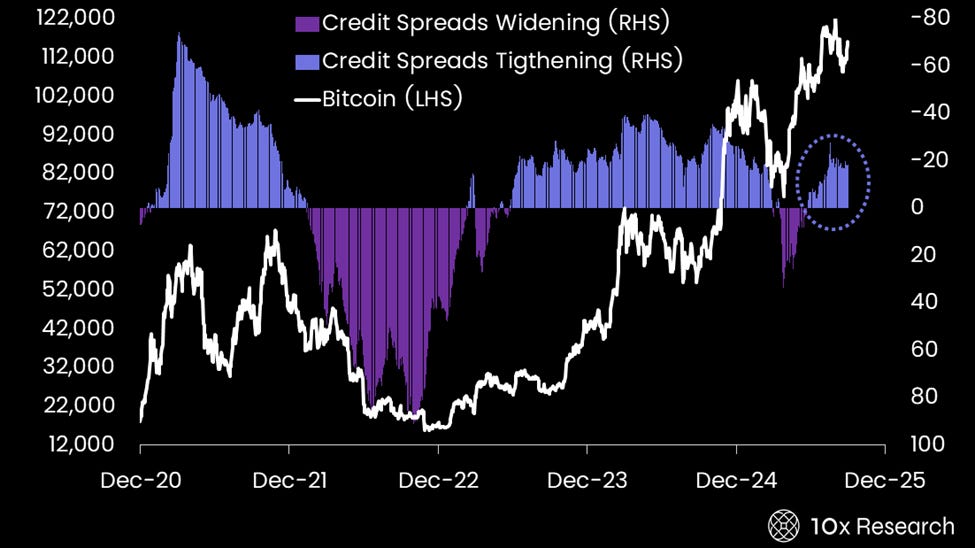

Bitcoin (LHS) vs. Credit Spreads (RHS, inverse)