Bitcoin Crashes to $98,000: The Warning Was Clear. When Does It Stop?

Actionable Market Insights

Why this report matters

Bitcoin’s latest drop has left traders scrambling for explanations, yet the real clues were visible weeks ago. Ethereum’s even steeper decline is revealing something deeper about this market cycle that most participants still don’t see. Under the surface, positioning, flows, and macro signals are shifting in ways that rarely coincide. A handful of indicators, quiet, data-driven, and historically reliable, are now pointing to a particular outcome. The question is whether traders will recognize what these signals imply before the next move occurs.

Main argument

Ethereum has now declined 17% since our October 31 report, “Why Shorting Ethereum May Be the Smart Move,” and prices have reached levels that indicate it is undervalued relative to transaction activity. However, as long as the broader crypto trend remains firmly downward, as we have been forecasting, there is no urgency to step in. In fact, Ethereum still sits roughly 10% above our initial downside target, and we believe that level remains at risk. Whether that target is ultimately reached will depend on several catalysts we outline below.

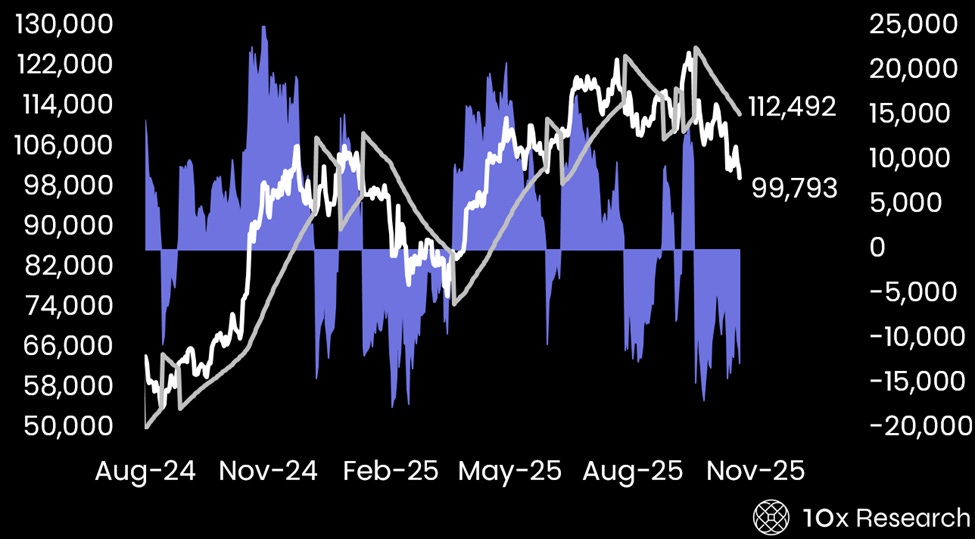

Bitcoin vs. our trend model (See Trading Signals)

But the story doesn’t end there. We have repeatedly warned that losing the $112,000 level would be critical (here, here, here), and since that breakdown, Bitcoin has fallen another 11%, once again validating the alpha in our research. Calling corrections is just as important as identifying rallies, because only by avoiding drawdowns can investors meaningfully outperform the market over time. We hope that, as a subscriber, you incorporated this analysis into your positioning, because this is exactly why we highlighted $112,000 as such a pivotal line. Many traders were caught off guard; you didn’t have to be.

Since October 10, both our Ethereum and Bitcoin trend models have been firmly bearish, and that signal remains intact. While trend systems can incur small losses when markets snap back quickly, they consistently generate strong returns over time because major crypto assets move in extended, high-volatility cycles. This is especially true when positioning pressures or macro catalysts are involved. Over the past few weeks, we’ve had both, which is why we repeatedly warned that this week’s rebound would fade quickly and that a revisit to the $98,000–$100,000 zone was likely (here). What is next? We explain below: