Bitcoin Didn’t Run Out of Buyers—It Ran Out of Permission.

Actionable Market Insights

Why this report matters

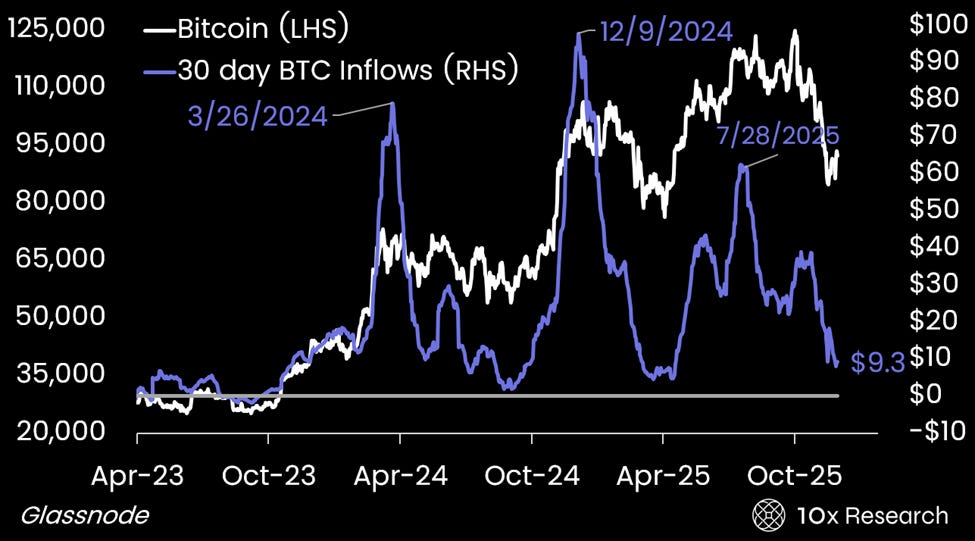

If we were allowed only one data point to determine a bullish or bearish stance, it wouldn’t be sentiment, global liquidity, stock-to-flow, or any other popular-but-low-signal framework. It would be our 30-day BTC inflow indicator, which has once again made clear that, despite rate-cut expectations and speculation about a dovish Fed chair in 2026, this is not a market to be structurally long outside of short tactical bounces.

Bitcoin (LHS) vs. our 30-day BTC Inflow Indicator (RHS, $ billions)

There have been only three major peaks in this indicator, and selling into each of them would have materially outperformed any narrative-based approach. The absence of sustained inflows also explains why no actual altcoin rotation has appeared: there hasn’t been enough capital at the top of the funnel to cascade downward.

Only when this indicator bottoms and turns higher will the next durable bull phase begin, but until then, rallies remain tactical, not transformational. Below, we outline why this indicator matters and the conditions required for BTC inflows to restart. This framework already allowed us to anticipate the October (bear market) breakdown (here), and it will do the same in identifying when the next sustainable rebound, not a tactical bounce, can truly begin.