Bitcoin: Everyone Sees Consolidation — Few See the Ice Wall Cracking

Actionable Market Insights

Why this report matters

Bitcoin looks calm on the surface — but the data says something very different. Beneath this sideways price action, long-term holders are quietly distributing while institutional flows hesitate, creating a fragile balance that rarely lasts. A slight shift in ETF demand, dollar strength, or Fed tone could determine whether this resolves into a squeeze higher or a break lower — and right now, both forces are colliding at a critical level.

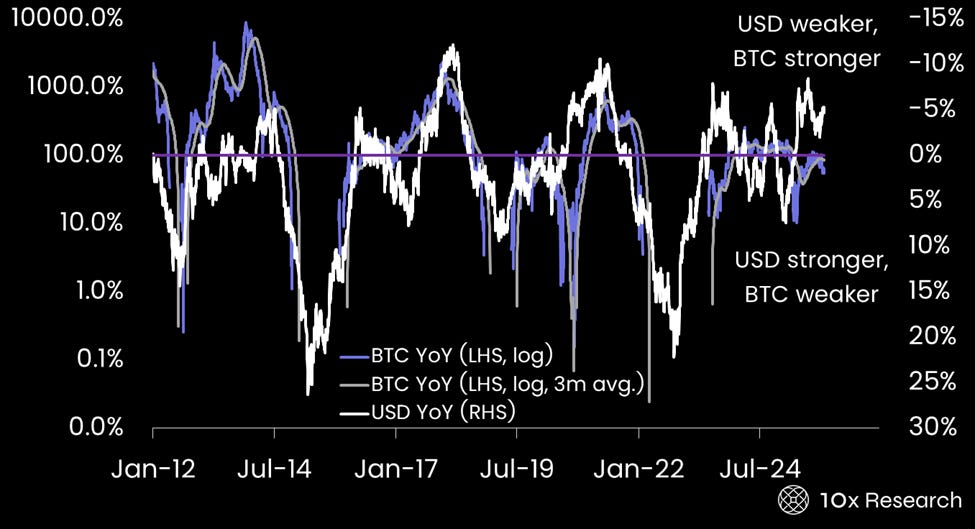

Bitcoin log returns (LHS) vs. US dollar strengthens/weakens (RHS)

The on-chain signals that usually move at glacier speed have started to change direction, hinting at a deeper structural turn. Most investors are watching headlines; the smart money is watching the threshold Bitcoin can’t afford to lose.

Main argument

At first glance, Bitcoin looks quiet — almost stuck. But beneath the surface, a massive handover is taking place: early adopters distributing, new capital absorbing, with flows nearly balanced enough to suppress volatility. When one side finally steps back, the imbalance could trigger a decisive move.