Bitcoin Hit Our $100,000 Target — Is It Time to Go Long Again?

Actionable Market Insights

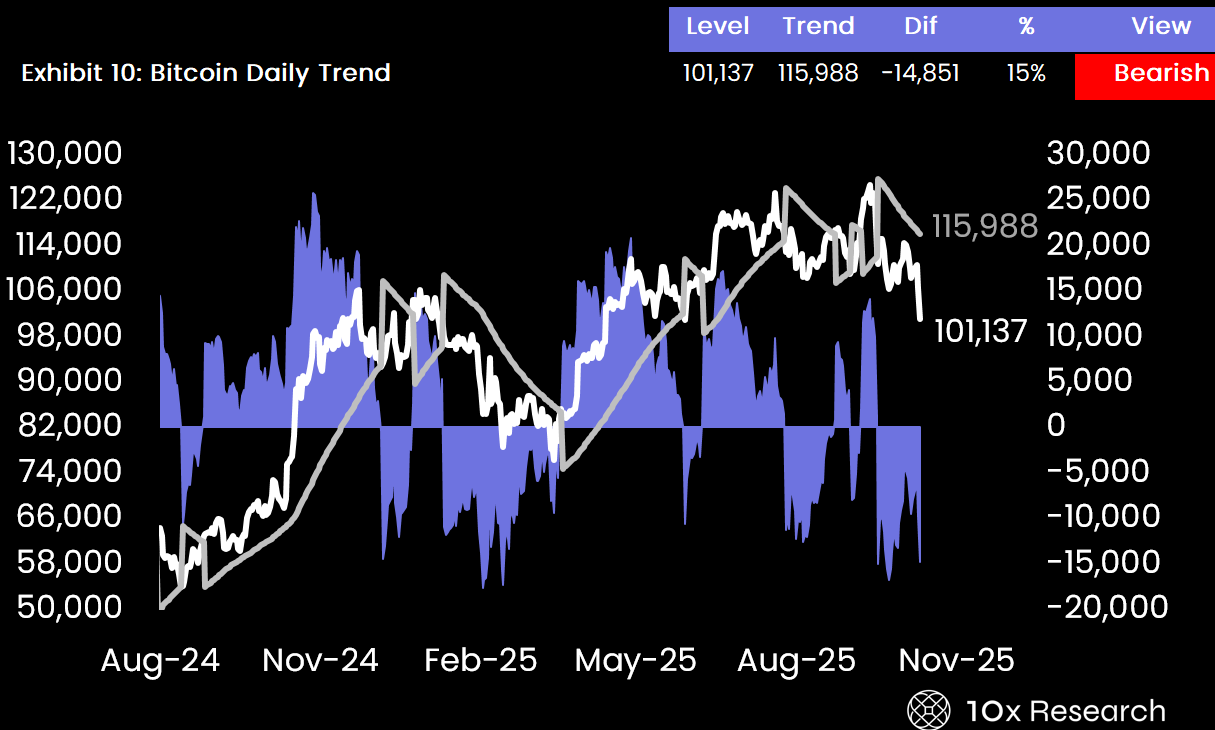

We remain structurally bullish on Bitcoin and the broader crypto-trading landscape, otherwise we wouldn’t dedicate our time to analyzing opportunities in this market. There will always be new opportunities, but consistent outperformance comes from discipline, following the data, flow dynamics, positioning, and technicals, and combining that with proprietary on-chain analytics. That disciplined process is what makes the difference, time and again. That’s exactly why our Trading Signals Dashboard platform exists, to highlight when trends turn. The model flipped bearish on Bitcoin around $113,000 on October 10.

Bitcoin (LHS) with our Trend Model - see here

That said, we’ve also been disciplined in calling key corrections, including August 2023, January 2024, March/April 2024, February 2025, and again in this latest pullback on October 22, 2025. In numerous recent reports have we predicted that Bitcoin would correct lower towards $100,000: see October 16: Bitcoin, knowing when to bet big – and when not to bet at all, or on October 22: Bear Market Watch: What Smart Money is seeing in Bitcoin’s Data), or on October 30: Bitcoin, everyone sees consolidation – few see the ice wall cracking.

The message these past weeks has been straightforward: if you don’t reduce exposure into strength, you can’t take advantage of weakness, and that’s where outperformance is created. Our calls on the 10–15% Bitcoin pullback and the 20% Ethereum correction played out exactly as anticipated.

On a $1 million portfolio, that swing represents roughly $150,000 in preserved capital; even on $100,000, it’s $15,000. In that context, the cost of our research is minimal relative to the value it provides. But with Bitcoin reaching our $100,000 target, the key question now is whether it’s time to reload. Let’s examine futures positioning to see what the market is telling us.