Bitcoin: Just a Relief Rally? Or Bull Market Restart?

Actionable Market Insights

Why this report matters

The market just survived a historic government shutdown, but the relief rally many expected may not be the one that matters. Beneath the headlines, institutional flows are quietly shifting, and one key liquidity signal just moved in a way we haven’t seen since the last major crypto inflection point. Meanwhile, U.S. growth data looks stronger than the labor market implies, raising the stakes for the December Fed meeting far more than consensus appreciates. Bitcoin held its first test of $100,000, but the real battle line sits elsewhere, and few traders are watching it. One specific indicator is already telling us whether ETF sellers are finished… or only just beginning.

Main argument

Although the U.S. government will finally reopen after a 40-day shutdown, the longest on record, little of substance appears to have been achieved; the episode was largely political theater rather than productive negotiation. And while shutdowns can weigh on growth at the margin, they were not the primary drivers behind the recent pullback in U.S. equities and crypto markets. As a result, any relief rally (purely) tied to the reopening is likely to be short-lived, with more meaningful macro pressures expected to reassert themselves.

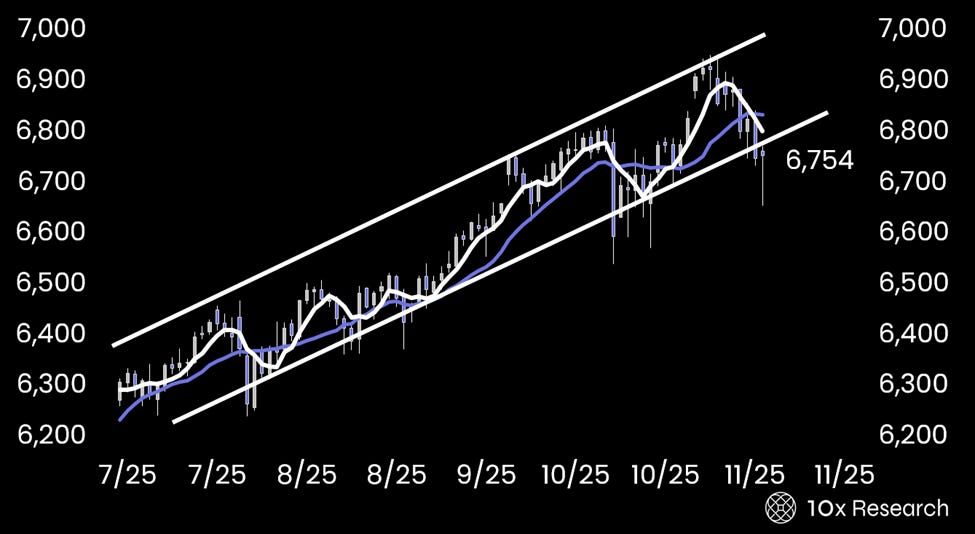

SP500 future