Bitcoin: Knowing When to Bet BIG — and When Not to Bet at ALL

Actionable Market Insights

Why this report matters

Bitcoin investors who entered the market only in recent years tend to be the most vocal advocates of “HODLing” through bear markets. At the same time, legacy investors and experienced traders make their decisions based on proven indicators and market signals. This distinction often separates winners from losers, with the savvy traders selling to the ignorant holders near the top. I’ve seen this play out in the last two cycles, as well as the one before that, when experienced traders locked in profits early, giving them the flexibility to buy back at much lower levels later on.

Roulette players almost always lose if they stay at the table long enough, watching the ball spin round and round. The odds are against them because roulette is a game of luck, not skill. Altcoins work in much the same way: while smart traders avoid games driven by chance, the uninformed often feel an irresistible urge to keep rolling the dice.

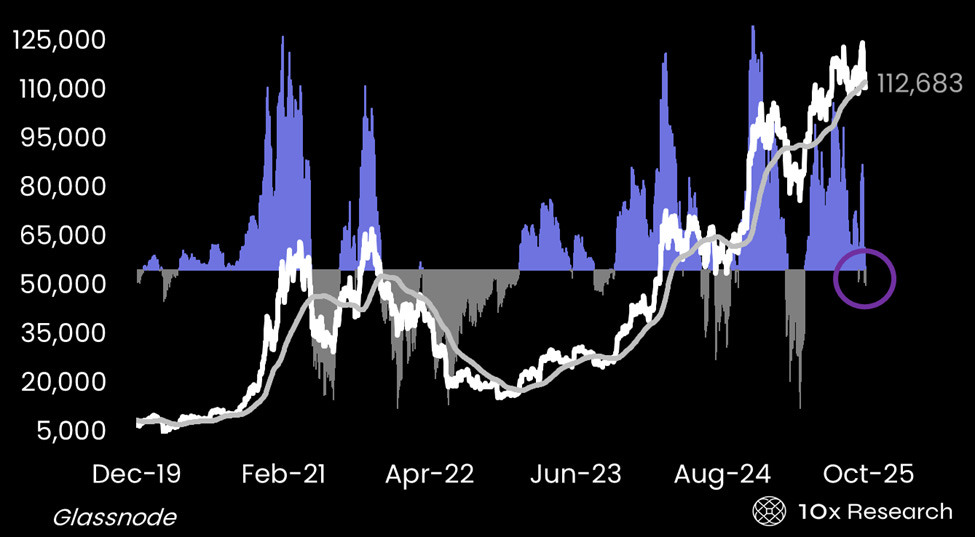

For Bitcoin traders, however, three key indicators help determine when to bet big and when to stay out altogether. We’ve discussed these indicators frequently, and while most of our readers are already familiar with them, it’s worth revisiting them once more. Given Bitcoin’s current levels, these indicators matter now more than ever.

Bitcoin - one of our three main indicators