Bitcoin: Smart Money Sold the Top — Did You? What Could Happen Next?

Actionable Market Insights

In November and December 2022, we delivered presentations across Hong Kong, Singapore, Vietnam, and Thailand, calling for a bottom in the Bitcoin bear market and projecting a significant rebound. At that time, most Wall Street economists were forecasting persistent inflation and an imminent U.S. recession, and our outlook was met with broad skepticism.

Identifying market lows can sometimes offer those rare, table-pounding moments when conviction is easier to express. Calling tops, however, is far more difficult, they are subtle, crowded with noise, and sentiment is often euphoric rather than fearful. Yet there are clear indicators that help us define those inflection points as well.

We have repeatedly outlined the key Bitcoin price levels derived from on-chain data and highlighted how price has historically behaved when those levels were breached. Over the past weeks, we have published multiple reports detailing these trigger zones and the technical signals that would confirm such a scenario.

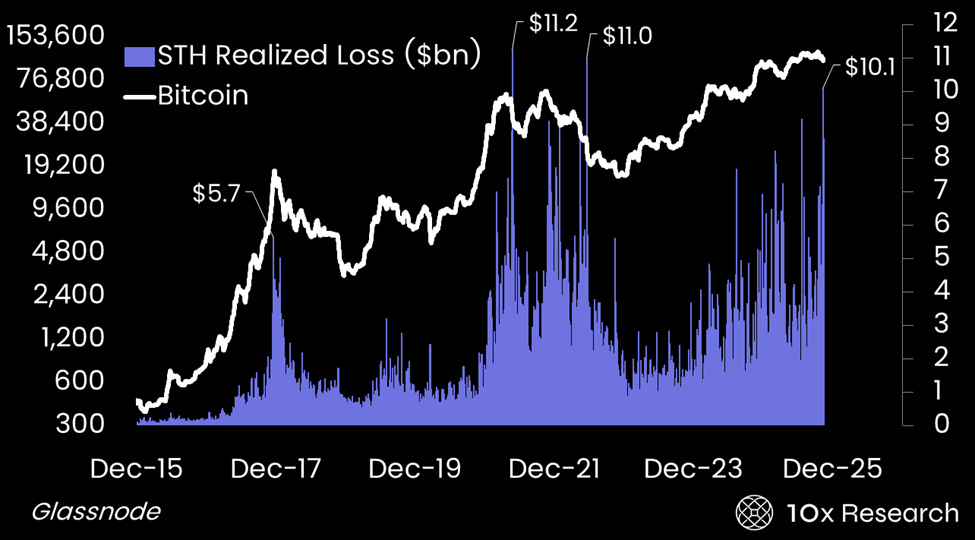

Bitcoin (LHS) vs. Realized Loss by Short-Term Holders (RHS, 1 day, $ billions)