Bitcoin Stalls, S&P 500 Hits Ceiling - Now What?

Empowering Traders with Insights

Why This Report Matters

Bitcoin has rallied 25% over the past month, supported by aggressive ETF inflows and institutional spot buying. But emerging signals—like a falling Coinbase premium and weak funding rates—suggest this momentum may be fading. Despite Bitcoin’s skew indicating some more upside (see here), macro pressures are mounting: the Fed remains neutral (meeting on May 7), volatility is creeping back, and uncertainty around tariffs looms. A potential consolidation is forming near the $95K level as traders await new catalysts. This is not a time for blind risk-taking but tactical positioning with well-defined exposure. The report outlines the key risks and explains how call spreads can help navigate this uncertain phase and how we are managing downside risk.

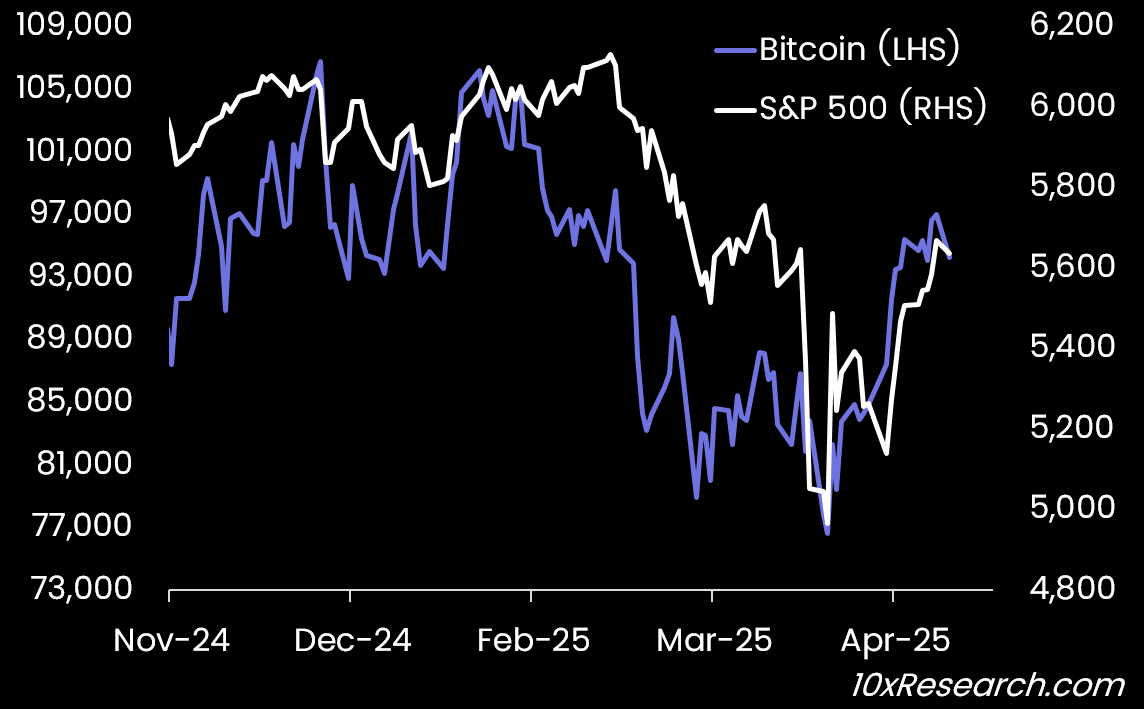

Bitcoin (LHS) vs. S&P 500 (RHS) could decouple…