Bitcoin’s BIG Consolidation Won’t Last Forever.

Actionable Market Insights

The report below focuses on Bitcoin’s medium-term outlook.

Bitcoin’s performance isn’t driven by cycles—it’s driven by how much new capital enters the market to offset those exiting. Unlike gold, Bitcoin’s price is less about interest-rate expectations and more about net new demand actually flowing into the asset. Monitoring the balance between Bitcoin’s demand and supply dynamics provides a powerful edge in forecasting where the market heads next.

Two dominant crypto themes are currently shaping the market narrative—and we’ve been ahead of both since early summer. The two key themes are that Digital Asset Treasury companies are exhausting their buying power, while selling pressure from legacy holders is temporarily capping Bitcoin’s upside.

We anticipated that Bitcoin’s volatility would contract as the momentum from the U.S. GENIUS Act faded, leaving the market in an “air pocket” during Congress’s summer recess. This slowdown in news flow was expected to dampen volatility, deflate the net asset value of Bitcoin treasury companies, and restrict firms like MicroStrategy from pursuing aggressive share placements and additional Bitcoin purchases—creating a natural cap on Bitcoin’s upside. Our forecast of a sharp rerating in MicroStrategy relative to Bitcoin has now materialized, with its NAV compressing to just 1.2x.

See our reports “Has MicroStrategy Lost Its Convexity Edge Over Bitcoin?” (July 19, 2025), “What Happens When MicroStrategy’s Bitcoin Yield Hits a Wall?” (July 25, 2025), “Are Hedge Funds Targeting MicroStrategy as Its Largest Holder Trims? And What’s the Trade?” (August 2025), and “Could Bitcoin/Ethereum Treasuries’ NAV Flip Negative?” (August 20, 2025).

Each of these analyses was published when Digital Asset Treasury companies were still seen as untouchable, celebrated by service-provider research teams and amplified by the media, long before the market began to recognize the vulnerabilities we had already identified. Instead of deploying billions, MicroStrategy is now purchasing only tens of millions—an amount too small to convince investors that fresh capital is driving Bitcoin’s next leg higher.

The second narrative currently capping Bitcoin’s upside is the realization that legacy wallets are offloading billions of dollars’ worth of Bitcoin—effectively selling into ETF demand. We identified this dynamic early in our June 20, 2025 report “Who’s Actually Impacting the Bitcoin Price?”, followed by “How Smart Money Is Quietly Capping Bitcoin’s Upside – And What Traders Must Do” (June 26, 2025) and “Why $8.6B in Dormant Bitcoin Just Moved—What It Means and How to Trade It” (July 5, 2025). It took time for the market to catch up to this narrative, but eventually the promoters ran out of bullish arguments to keep it alive.

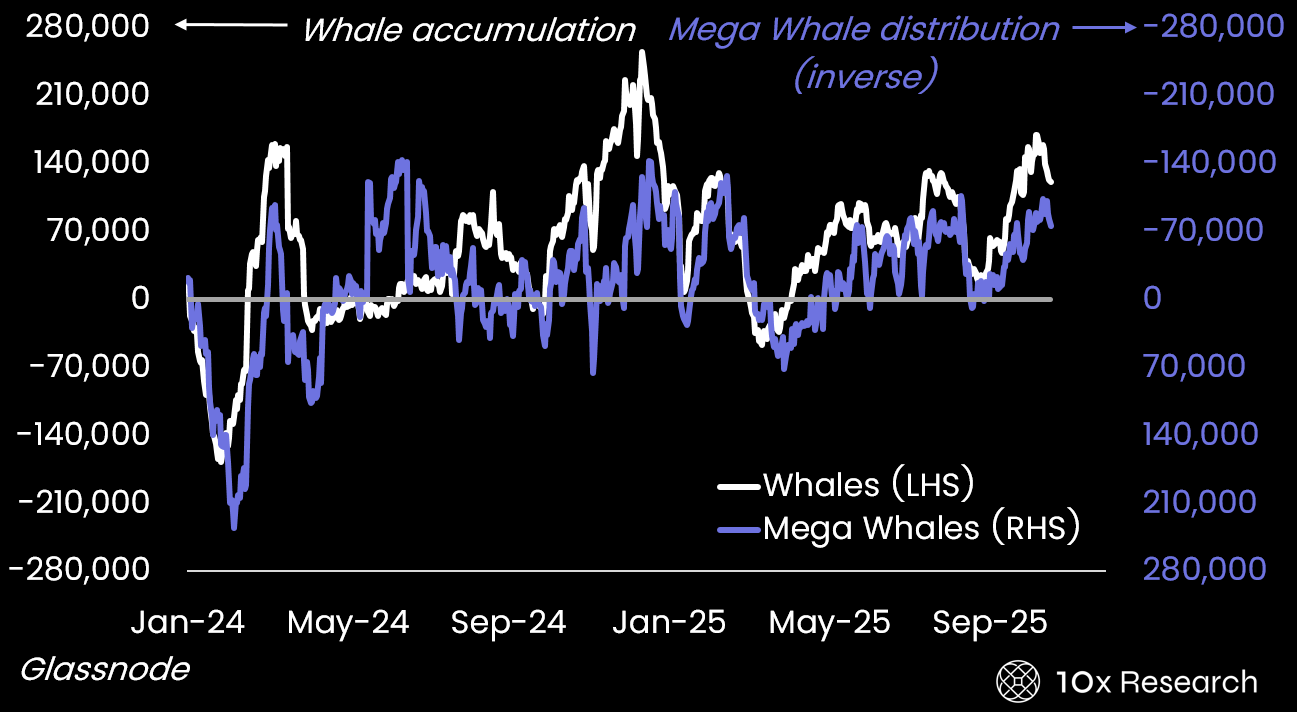

A Perfect Balance: Whale Buying Offsets Mega-Whale Selling (in BTC)

Since June, our analysis showed that these legacy holders were selling only as much as ETFs and new entrants could absorb, preventing a market collapse but creating a new equilibrium. In this environment, Bitcoin’s volatility was bound to decline—and the optimal strategy was to sell volatility, as prices were likely to remain range-bound.

Until recently, selling volatility had been among the most profitable strategies in recent months. Despite the leverage-driven flash crash, Bitcoin remains roughly mid-range around $110,000. While legacy wallet distribution may eventually subside, and assuming ETF and institutional demand stays supportive, prices could still recover and trend higher. Below, we outline when the inflow impulse stalled and how long the current supply overhang could persist. Understanding these dynamics helps build a roadmap for when Bitcoin is likely to resume its next leg higher. As we explain below: