Bitmine’s $1.3 Billion Ethereum Loss — What's the Trade here?

Actionable Market Insights

Why this report matters

Ethereum lost its most aggressive buyer, and the market is only beginning to price that in. That’s why, in our October 31, 2025 report “Shorting Ethereum May Be the Smart Move,” we warned that key technical levels were about to give way, and they have. Since then, Ethereum has broken several layers of support. ETF flows have flipped from euphoria to apathy, retail interest has collapsed, and the last major support level now sits precariously beneath the price action.

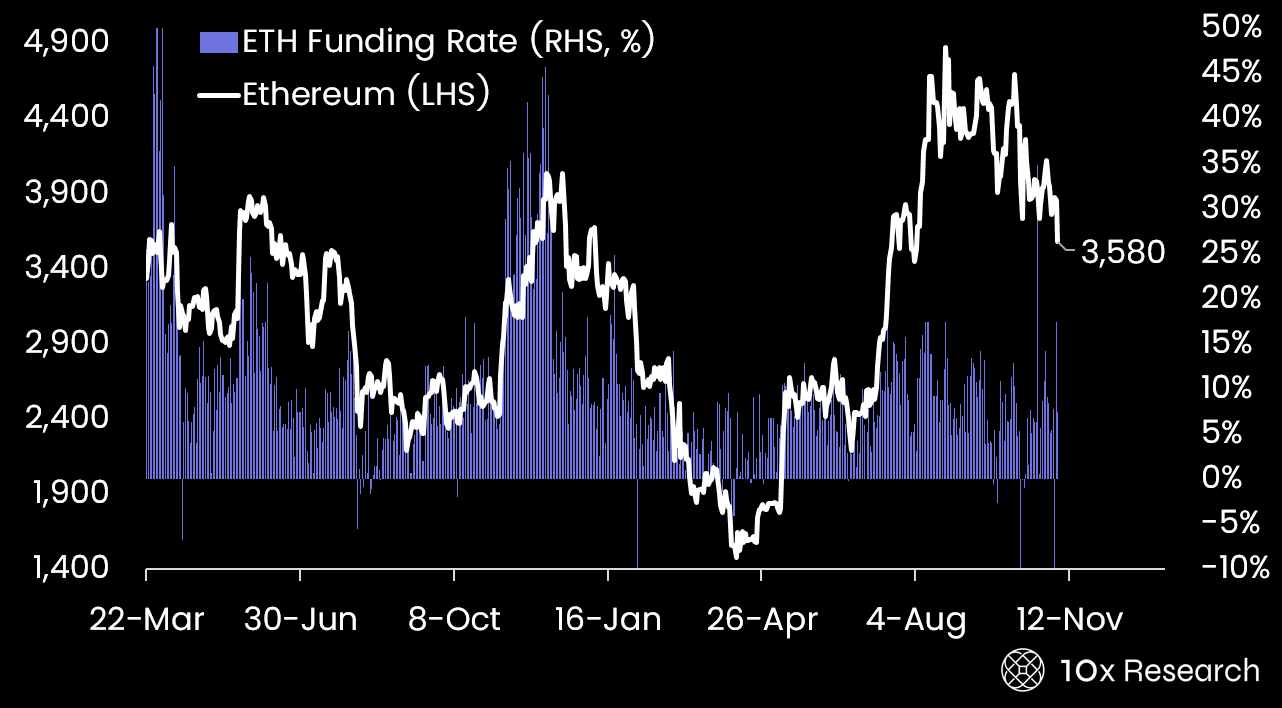

Ethereum (LHS) vs. ETH Funding Rates (RHS)

For months, Bitmine drove the narrative and the flow, now it’s fully deployed, sitting on over $1.3 billions in unrealized losses with no dry powder left. The question investors aren’t asking yet: if Bitmine can’t buy the dip, who will? Meanwhile, options positioning and on-chain trends suggest the unwind has room to accelerate, not fade. If the next level breaks, the conversation around Ethereum won’t be about dips, it will be about exits. There’s still opportunity here, and the most compelling ways to position around this theme are outlined below.