Coinbase Was the First Target. Now Hedge Fund Sharks Circle a New Crypto Stock as a Short Squeeze Looms

Actionable Market Insights

Why This Report Matters

Crypto equities are entering a potentially decisive moment. Weak earnings, elevated short interest, expiring lock-ups, and shifting regulatory signals are colliding at a time when positioning appears increasingly asymmetric. While headline fundamentals remain mixed, options markets, insider behavior, and short positioning suggest that the next move may be driven less by earnings themselves and more by how crowded the trade has become.

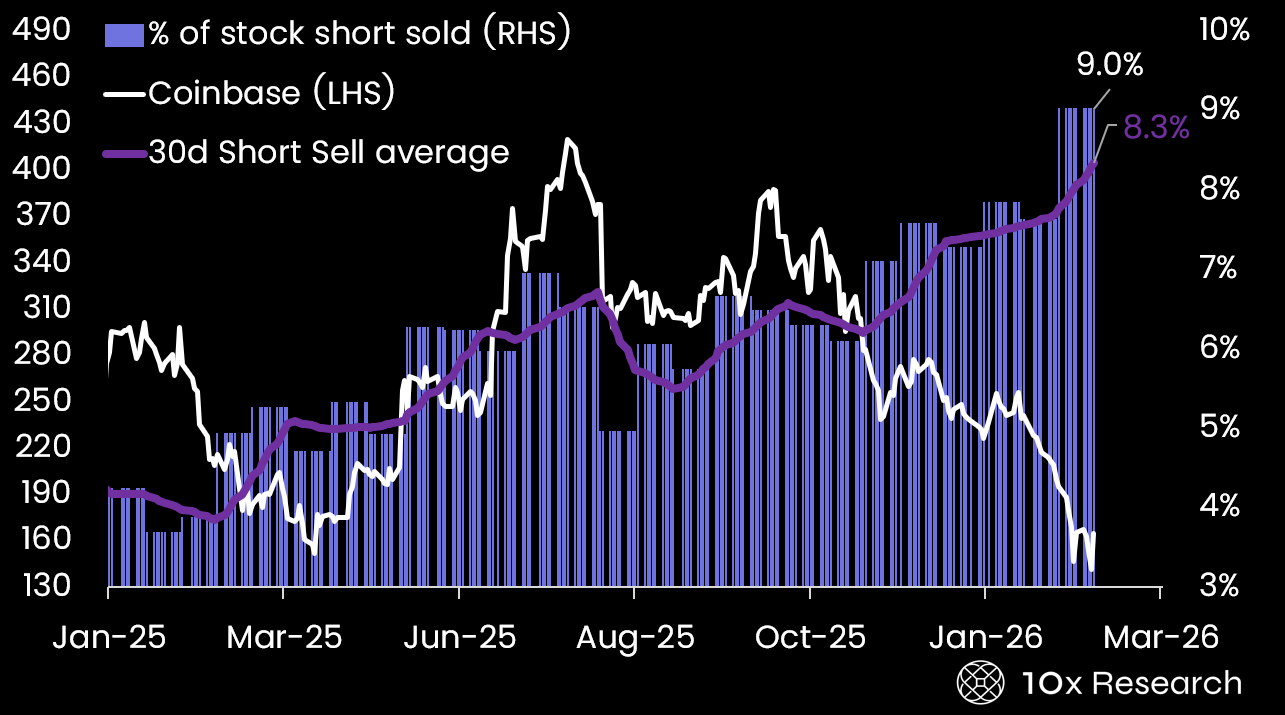

Hedge funds were aggressive short sellers of Coinbase during the last Bitcoin bear market, but they made a critical mistake near the cycle’s end. Even as Bitcoin began to recover and Coinbase shares rallied sharply, short interest continued to rise, a late bearish push that ultimately proved costly.

Today, despite its liquidity, competitive pressures, and still sizeable market capitalization, Coinbase is not the primary short target within crypto equities. Instead, hedge funds have concentrated their bearish positioning elsewhere. There is another crypto stock where short interest has built up meaningfully, and with several catalysts approaching, those “sharks” may need to reassess quickly, especially if the tide begins to turn against them.

Coinbase (LHS) vs. % of the shares shorted by Hedge Funds (RHS)