Crypto Leverage Just Snapped

Actionable Market Insights

Why this report matters

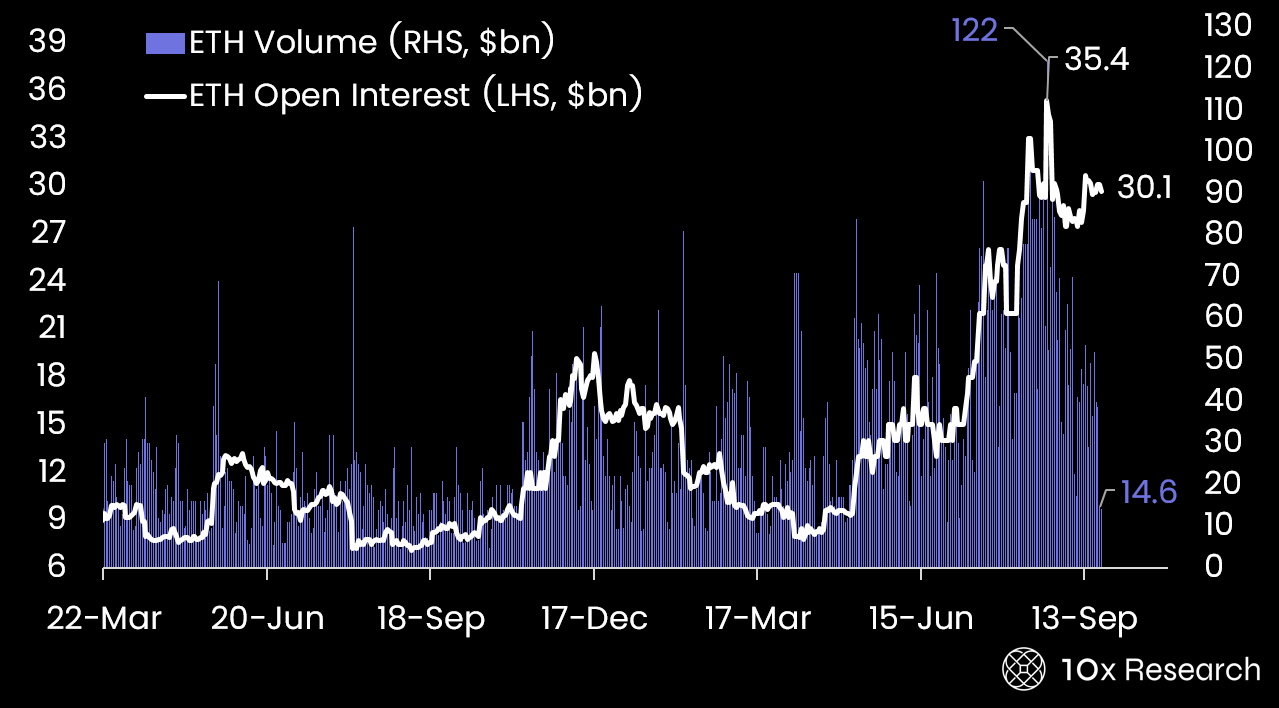

Yesterday, we felt compelled to publish a rare Sunday note, “Why High Leverage and Low Liquidity Could Be a Dangerous Mix,” warning that “the combination suggests faster traders are turning more cautious, leaving BTC, ETH, SOL, XRP, vulnerable to volatility spikes if liquidity remains thin.” Today, that risk is playing out: Ethereum, Ripple, and Solana each fell around 8% as leveraged futures traders were forced into liquidations.

Ethereum Open Interest (LHS) vs. ETH Volumes (RHS)

With volumes and on-chain activity already thinning, the move confirms our call for a 1–2 week post-FOMC consolidation as we enter a crucial seasonal holiday period. The price action also echoes our 10x Weekly Crypto Kickoff, “Leverage Is High, Liquidity Is Thin—Which Crypto Cracks First?”

Main argument

Each rally has been short-lived, quickly giving way to weakening market structure and extended consolidation phases. While the FOMC meeting sparked optimism for a Q4 breakout, Bitcoin was more likely to enter a 1-2 week consolidation phase immediately afterward. That view was reinforced in our September 21 report, where we warned that large leveraged longs were increasingly vulnerable as liquidity thinned—raising the risk of a downside break. On-chain metrics provide further evidence that market activity is once again fading. The real question: how long can this consolidation drag on?