Crypto One Liners: What’s Driving the Market in a Minute - February 15

Actionable Market Insights

CRYPTO CURRENCIES

Bitcoin is facing institutional ETF outflows and macro-driven pressure, but whale accumulation and better inflation data have supported a price rebound.

Ethereum declined due to record ETF outflows and forced liquidations, while whale accumulation and asset manager transfers signal institutional repositioning.

Solana faces mixed sentiment as whale selling pressures prices, but institutional adoption, tokenization pilots, and infrastructure upgrades support long-term demand.

XRP is supported by strategic tokenization partnerships and whale accumulation, though large transfers reflect ongoing institutional repositioning and caution.

BNB Chain is benefiting from strong ecosystem growth, rising real-world asset adoption, and a new $1 billion builder fund driving network activity.

Tron is supported by treasury accumulation, dominant stablecoin settlement activity, and growing institutional interest, including potential ETF developments.

TON is gaining momentum due to Telegram wallet integration, mass adoption initiatives, and expanding ecosystem infrastructure.

Hedera is attracting institutional attention through futures expansion, enterprise partnerships, and growing real-world asset tokenization adoption.

Monero is benefiting from new cross-chain functionality and growing privacy demand, despite continued regulatory scrutiny.

Aave is strengthening due to governance reforms, improving value capture mechanisms, and expanding institutional DeFi integrations.

Hyperliquid is gaining institutional credibility through record trading volume, token buybacks, and major institutional token purchases.

Zcash is benefiting from roadmap improvements, institutional developments, and structural changes enhancing long-term network reliability.

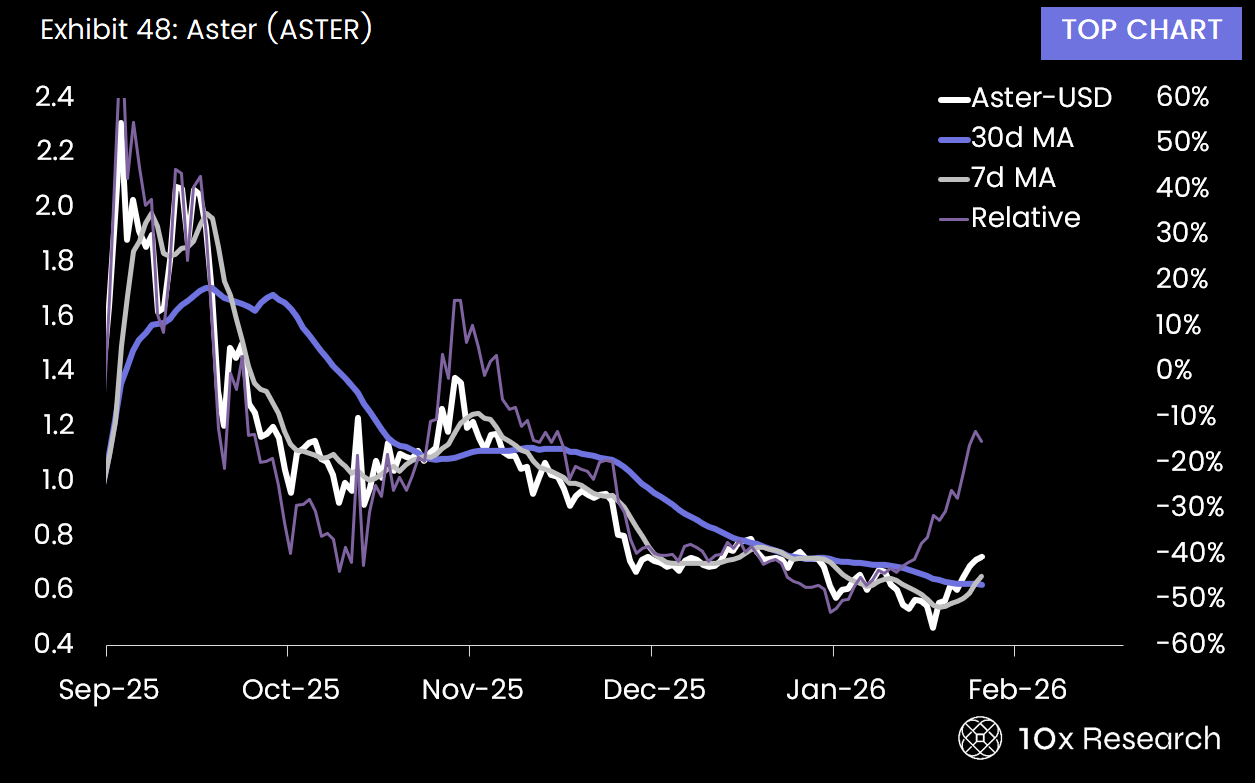

Aster is strengthening due to supply reduction initiatives, ecosystem upgrades, and new liquidity-generating infrastructure.

MakerDAO is gaining momentum from its Endgame restructuring, expanding DAI adoption, and increasing institutional usage and relevance.

CRYPTO STOCKS

MicroStrategy: MicroStrategy faces dilution concerns and large unrealized losses, though its capital structure shift aims to reduce future shareholder impact.

Riot Platforms: Riot’s AI infrastructure expansion and large power capacity are driving investor interest despite weak near-term earnings expectations.

Bitdeer: Bitdeer faces earnings quality concerns and cash burn risks despite strong operational growth and expansion into AI infrastructure.

Cipher Mining: Cipher is gaining institutional backing and strategic partnerships as it transitions into a major AI infrastructure provider.

Galaxy Digital: Galaxy’s buyback program and pivot toward AI infrastructure improved sentiment despite declining trading volumes.

Coinbase (earnings section): Coinbase rebounded strongly after earnings on diversification optimism and rising trading activity despite analyst downgrades.

IREN: IREN’s index inclusion and AI financing strengthened investor confidence despite near-term accounting losses.

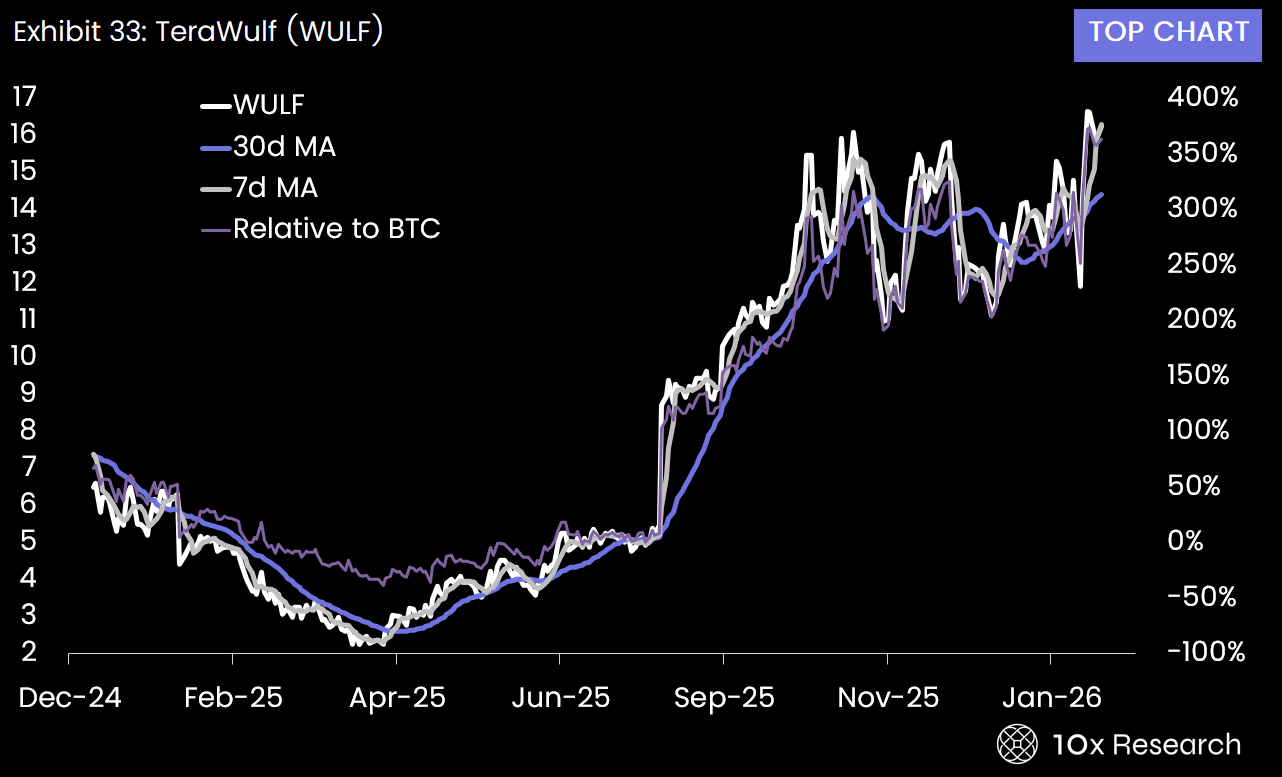

TeraWulf: TeraWulf surged on analyst upgrades, institutional backing, and strong positioning in AI infrastructure.

Robinhood: Robinhood faces revenue pressure from declining crypto trading, but institutional buying and new initiatives support long-term growth.

Metaplanet: Metaplanet continues aggressively expanding its Bitcoin treasury despite impairment risks, supported by strong projected revenue growth.

Core Scientific: Core Scientific gained investor interest due to its AI infrastructure contracts and strong long-term revenue potential.

Circle: Circle is benefiting from institutional accumulation and growing USDC adoption across financial and prediction market infrastructure.

Bitmine Immersion: Bitmine is attracting institutional capital and expanding its Ethereum treasury while preparing new staking revenue streams.

CEA Industries: CEA Industries faces governance disputes and volatility but maintains compliance and strengthened oversight.

MACRO

S&P 500: AI disruption fears weighed on broader equities, while select AI infrastructure beneficiaries continued attracting strong investor demand.

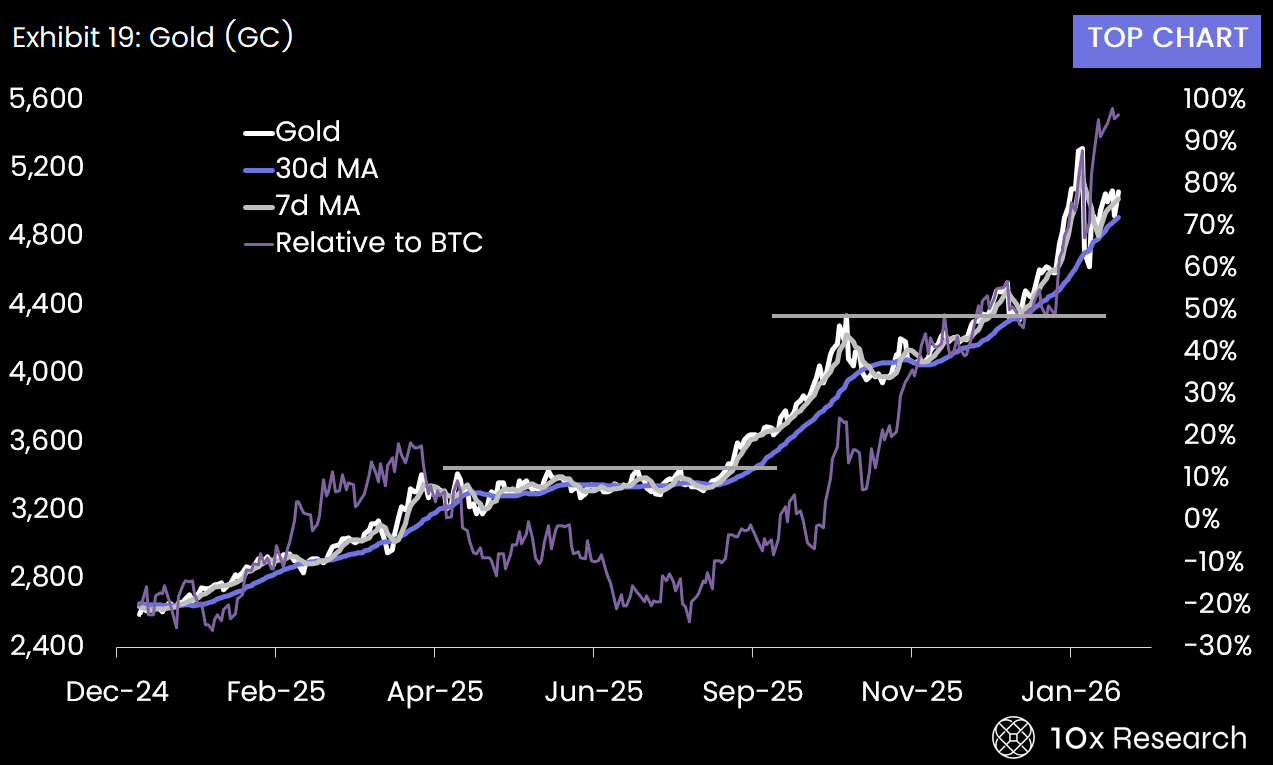

Gold: Gold rallied on falling inflation and continued central bank accumulation, reinforcing its role as a structural hedge.

Treasury Yields: Falling inflation and strong bond demand pushed Treasury yields lower, signaling growing expectations for future rate cuts.

Detailed cryptocurrency charts and comprehensive crypto stock analysis are available in our Trading Signals and Trading Strategy reports.

Disclaimer: This email and any attached research are for informational purposes only and do not constitute investment advice, financial advice, or a recommendation to buy or sell any assets. 10x Research does not provide personalized investment advice and is not registered as a broker-dealer or investment adviser. Views are the authors’ own and subject to change. Please consult a qualified professional before making financial decisions. ©10x Research.