Crypto Stock Weekly: Key Earnings, Deals, and Shifting Market Sentiment

Actionable Market Insights

In partnership with:

ZIGChain (ZIG) is a purpose-built Layer 1 blockchain for wealth generation. Powered by an innovative wealth management module, ZIGChain enables anyone to co-invest alongside professional fund managers in real-world assets (RWAs), while supporting institutional adoption and regulatory compliance. At the heart of this democratized investment ecosystem is the ZIG token, which powers governance, transaction validation, and incentivizes network growth. Learn more: zigchain.com

Crypto Stock Weekly: Key Earnings, Deals, and Shifting Market Sentiment

Bitcoin

Bitcoin hit a record above $124,000, fueled by Wall Street momentum and supportive policy, before profit-taking and leveraged wipeouts pushed it back below $120,000. Hotter U.S. PPI data further dampened sentiment, reducing rate-cut expectations and adding selling pressure.

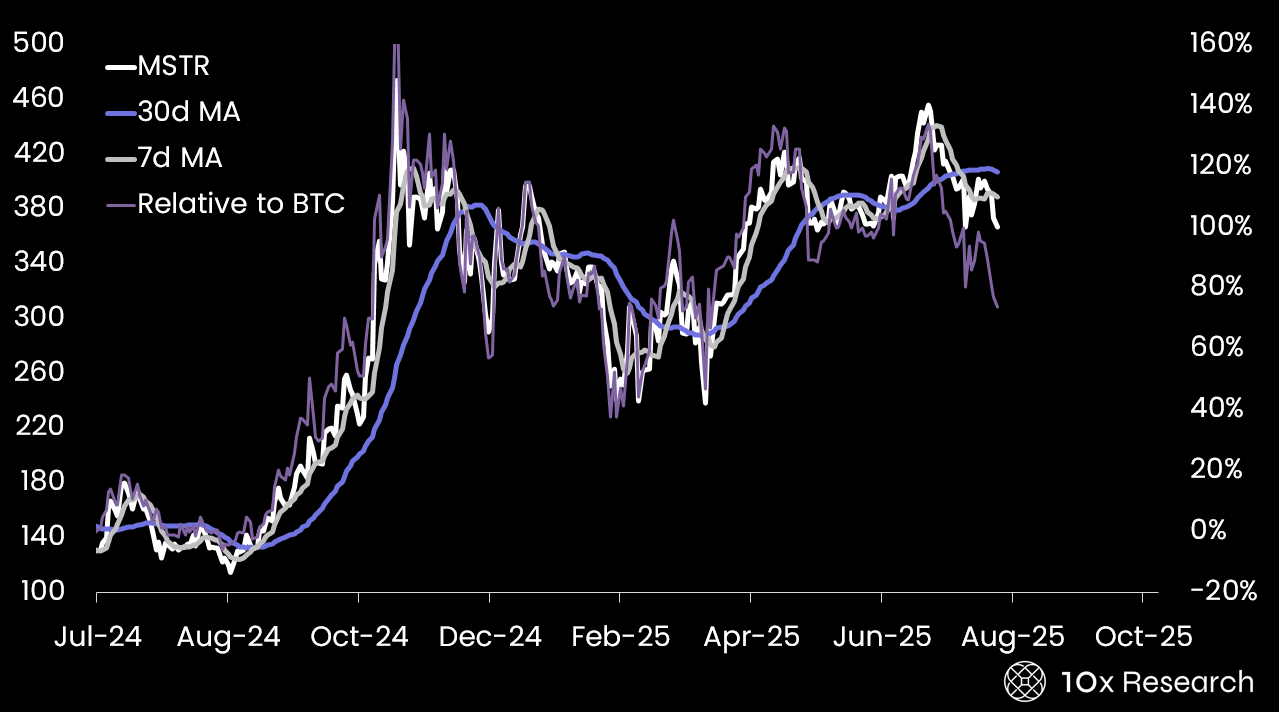

MicroStrategy

MicroStrategy shares fell as concerns over dilution resurfaced with a nearly $2.8B preferred share offering. Investors remain wary of its aggressive leverage and equity issuance to fund Bitcoin accumulation, weighing on sentiment.

Nasdaq / Tech Stocks

AI-driven earnings from big tech boosted the Nasdaq and S&P 500, lifting market sentiment. However, chip-sector caution from Applied Materials and Cisco tempered enthusiasm, sparking investor rotation.

CleanSpark

CleanSpark dropped despite record-breaking 91% revenue growth and strong Q3 earnings. Institutional investors, including pension funds, increased stakes, signaling long-term confidence despite the sell-off.

Galaxy Digital

Galaxy secured $1.4B financing for its Helios AI datacenter, highlighting a strategic shift into AI infrastructure. Yet insider share sales, including by the CEO, cast doubt and pressured the stock.

Coinbase

Coinbase posted mixed results, missing revenue and profit expectations but beating on adjusted EBITDA. A planned share offering weighed on optimism, raising supply concerns despite margin resilience.

Hut 8

Hut 8 rallied on strong Q2 results and a merger plan with Gryphon Digital Mining. A new Dubai license boosted investor confidence in its global expansion strategy.

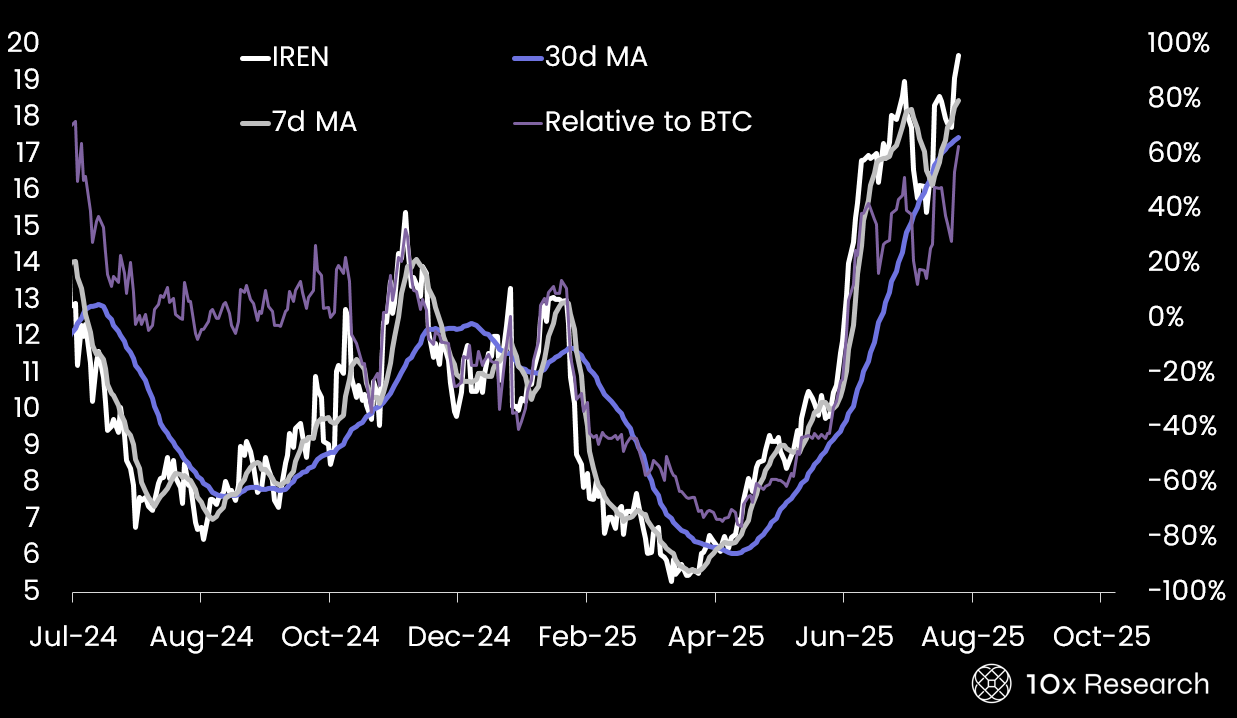

Iren

Iren gained on strong mining results and expanded AI GPU capacity. However, weaker-than-expected earnings and reduced institutional stakes tempered enthusiasm.

TeraWulf

TeraWulf surged on a $3.7B AI hosting deal with Google-backed Fluidstack. The agreement secured long-term capacity and financing, cementing its role in high-performance compute.

Robinhood

Robinhood jumped past a $100B market cap with record deposits, trading volumes, and margin balances. Strong crypto-driven growth reinforced its evolution into a major brokerage platform.

Metaplanet

Metaplanet slumped despite adding 775 BTC, raising doubts about its aggressive accumulation strategy. The disconnect between Bitcoin purchases and share performance highlights investor skepticism.

Northern Data

Northern Data dropped after Rumble’s $1.17B takeover bid valued shares far below market. The deal has Tether’s backing and could reshape revenue through GPU supply agreements.

Bit Digital

Bit Digital slid after reporting weak revenue despite an EPS beat. A sharp decline in trading volume and concerns over its strategic pivot left sentiment fragile.

Core Scientific

Core Scientific fell on disappointing earnings and steep losses. Shareholder opposition to its CoreWeave merger added pressure, raising doubts about the deal.

Circle

Circle rose on strong post-IPO earnings but momentum faded after announcing a 10M-share offering. Its launch of Arc, a USDC-powered blockchain, highlights ambitions in payments and enterprise settlement.

Bitmine Immersion

Bitmine Immersion rallied 50% on institutional flows and Ethereum accumulation. Bold ETH price speculation fueled additional momentum, despite skepticism.

Sharplink Gaming

Sharplink initially jumped on a $400M direct offering and rising ETH holdings but reversed after weak Q2 results. Heavy losses and revenue declines fueled continued share pressure.