Crypto’s Biggest Liquidation Since 2021 – Buy the Dip or More Pain Ahead?

Actionable Market Insights

Why this report matters

Crypto just experienced one of its largest liquidation waves in years, with Ethereum at the center of the storm. History shows these events often mark turning points—but this time, the signals are more complex. Funding rates have flipped negative, yet positioning and technical levels paint a very different picture. At the same time, futures open interest in Bitcoin and Ethereum has surged by tens of billions, raising questions about who is really holding the risk. Meanwhile, critical support levels are being tested, and the market’s reaction here could shape the next big move.

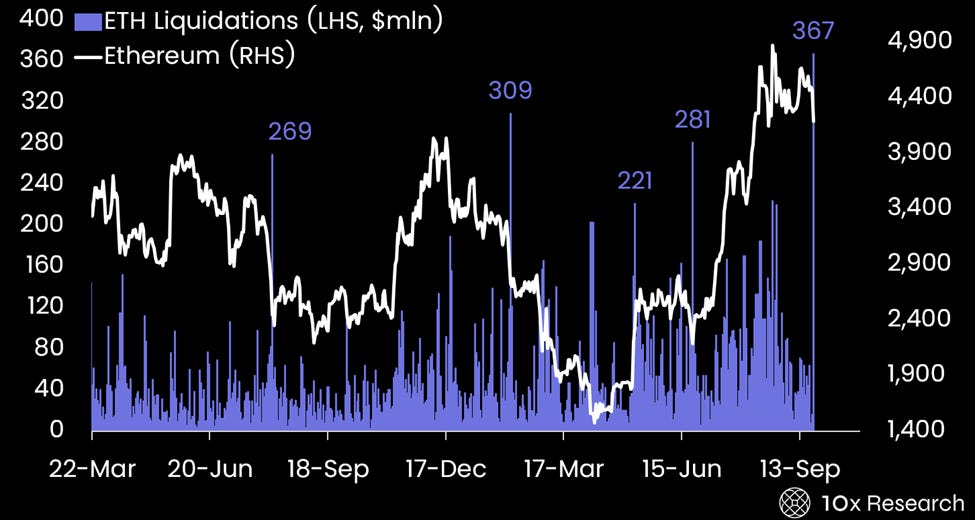

ETH Liquidations (LHS, $ millions) vs. Ethereum (RHS)

Main argument

The crypto market, led by Ethereum, just experienced one of its largest liquidation events, the biggest since September 2021. Historically, such spikes often mark local lows and increase the probability of a rebound, a view reinforced by negative funding rates, which show that faster traders are now net short. However, before rushing to “buy the dip,” traders should weigh key considerations around positioning, technical signals, and how the market is priced heading into October.

In our reports from September 21 (here) and 22 (here), 2025, we highlighted that leveraged long positions were highly vulnerable given abnormally low liquidity and trading volumes relative to elevated positioning. Earlier, in our September 16, 2025, note, we cautioned that while many viewed a Fed rate cut as bullish, markets often consolidate in the two weeks following such moves, particularly as they overlap with S&P 500 futures and options expiries.