Did Binance Just Socialize Hundreds of Millions in Losses—Triggering a New Wave of Altcoin Liquidations?

Actionable Market Insights

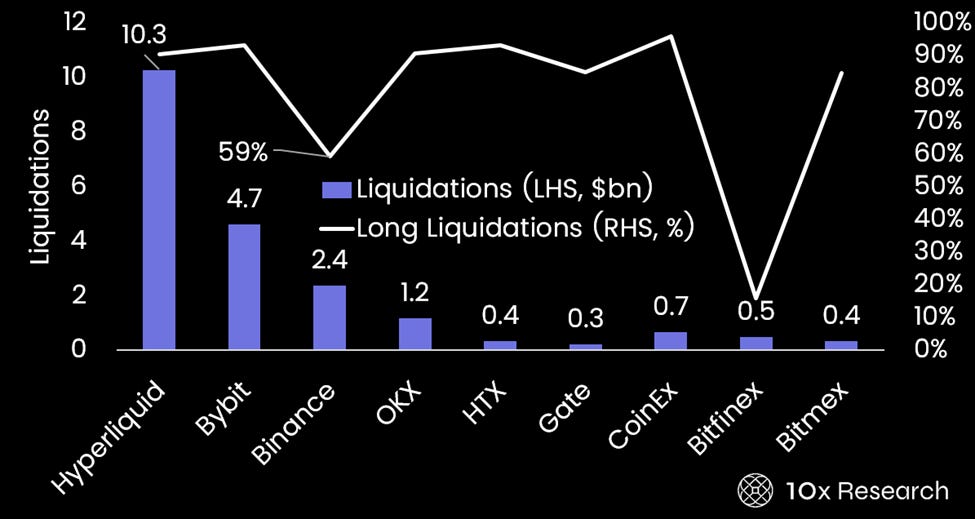

As we noted a week ago, during the $19.6 billion crypto liquidation event, long liquidations on Binance accounted for only 59% of all liquidations—far lower than the 90%+ seen on other exchanges. This divergence highlights the role of ADL (Auto-Deleveraging), a risk mechanism employed by derivatives platforms such as Binance to protect the system when liquidations can’t be filled quickly enough during volatile market moves. In a crash, ADL may automatically close or reduce profitable positions held by other traders, often market makers or market-neutral funds, to offset the losses of bankrupt accounts.

Long Liquidations during last week’s crash - Binance unusually low

For hedge funds and market makers holding long-short positions across exchanges, this can unexpectedly break hedges and create sudden directional exposure, turning “neutral” books into loss-making ones. That’s why we argued this crash was unlikely to produce a V-shaped rebound and would instead lead to further deleveraging, particularly in altcoins.

The 41% of short liquidations remains significant—it may take days or even weeks to understand how and at what levels Binance unwound positions. Affected funds and market makers are now focused on tightening risk and reducing exposure, likely by selling altcoins rather than seeking fresh profit opportunities.