Everyone Is Bullish on 2026—The Data Disagrees.

Actionable Market Insights

Why this report matters

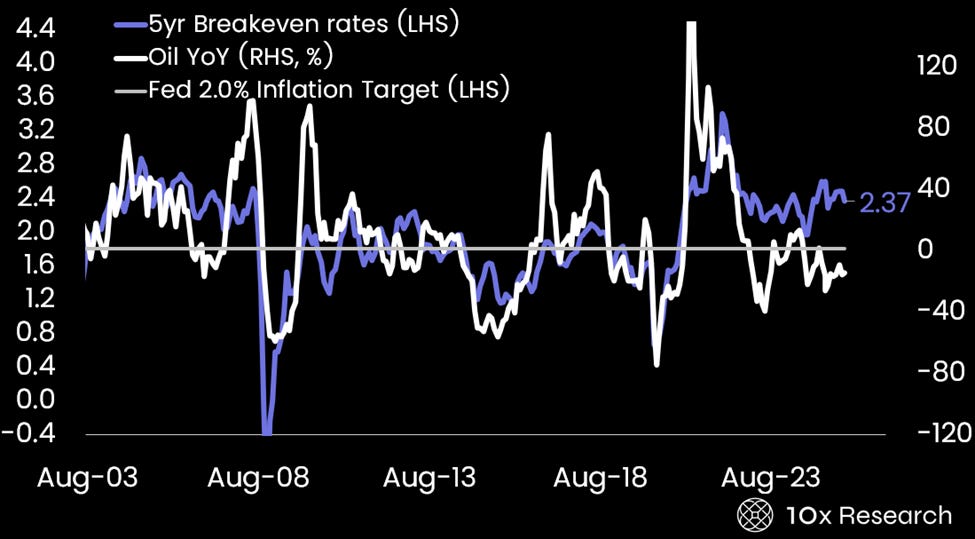

Set aside the bullish narratives dominating Wall Street, this report takes a hard look at what the underlying data is quietly signaling as we approach 2026. Several widely watched indicators are beginning to diverge in ways that historically precede regime shifts in markets, even as consensus remains complacent. Inflation dynamics, labor-market trends, and rate expectations are no longer moving in sync, creating a macro backdrop that is far more fragile than headline optimism suggests.

At the same time, key asset classes are flashing signals that leadership may be narrowing and volatility may not remain contained for long. Understanding whether these developments signal a benign slowdown or something more disruptive requires careful analysis, not surface-level narratives.

Disinflation is coming supporting Fed rate cuts, is this bullish?

Main arguments

Set aside the pep talks from Trump, Wall Street strategists, and crypto commentators touting bullish 2026 narratives. Market realities may soon prove less accommodating. This is a critical moment to focus on the underlying data. Investors need to decide for themselves whether to remain fully exposed to the bullish 2026 narrative or shift toward a more defensive posture.

As we wrote at the end of October, only those who sell high are positioned to buy low (See October 31: Hedging Bitcoin? Why Shorting Ethereum May Be the Smart Move. How Low Could ETH fall?). Since then, Bitcoin has declined by 23%, and that volatility now appears to be spilling over into other risk assets.