Everyone’s Talking About a Bitcoin Bear Market — Smart Traders See Something Else

Actionable Market Insights

Please note: Sharing our research with non-subscribers is strictly prohibited. If we become aware of unauthorized distribution, we are obligated under our Terms of Service to close the account immediately, without warning and without second chances. Thank you for respecting the value of your subscription and our work.

Everyone’s Talking About a Bitcoin Bear Market — Smart Traders See Something Else

Why this report matters

Many traders have suddenly turned bearish, yet most are neither short nor neutral; they’ve stayed long and are now feeling the pain. The familiar “three years up, one year down” bear-market narrative is circulating again, but the real question is whether it’s time to trade against consensus or whether this is just another trap. The distinction between tactical and structural positioning matters, as risk–reward dynamics can shift quickly when positioning becomes crowded. Complacency is dangerous in this environment, as we demonstrated when we turned decisively bearish at the end of October (here).

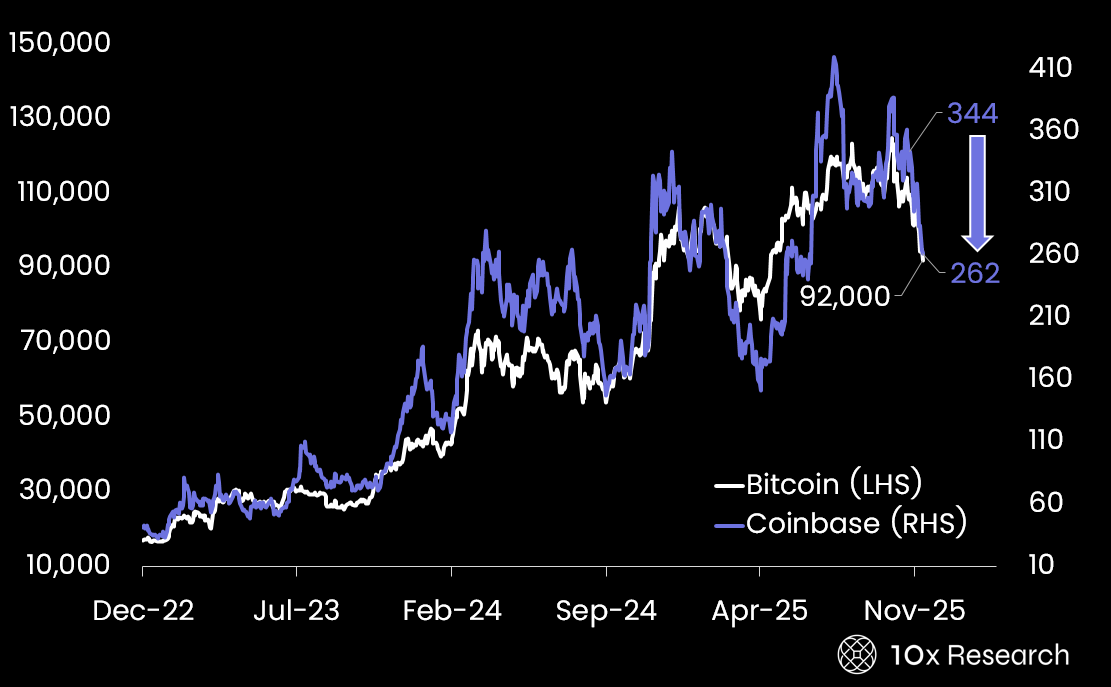

On November 2, we highlighted the opportunity to sell Coinbase’s elevated implied volatility after earnings, where traders could collect nearly 5% in option premium into mid-December 2025 as long as the stock didn’t rally from $344 to $390 (here). With Coinbase now at $261, that option premium has indeed collapsed to nearly zero ($1.07). At that time, the stock was overvalued by 7%; today, after a 24% decline, it is merely fairly valued, and we see new opportunities emerging in other parts of the market.

Bitcoin (LHS) vs. Coinbase (RHS) - currently “fairly valued”

Main argument

Bear markets are notoriously difficult to trade, but their combination of sharp drawdowns and sudden relief rallies creates abundant opportunities. This is not a time for complacency. Many of the most successful traders built their fortunes during bear markets. In 2008, for example, we shorted Japanese shipping companies into the Global Financial Crisis, even though their order books were filled for years and demand far exceeded supply.

The companies looked unbreakable, until the crisis hit, orders were canceled overnight, and China flooded the market with new ships. The situation today has echoes of that period: the AI chip build-out appears unstoppable, with endless orders and massive commitments from firms like OpenAI, but conditions that seem “indefensible” can change remarkably fast.

Bitcoin is now testing its bull-market uptrend, and while this line has been touched several times before, each instance has marked meaningful bottoms, sometimes tactical, sometimes strategic. Is this the time to buy or become really concerned? Let’s go through some data and decide what to do next!