Extracting Free Bitcoin Optionality from Coinbase. Timing is critical.

Actionable Market Insights

Why this report matters

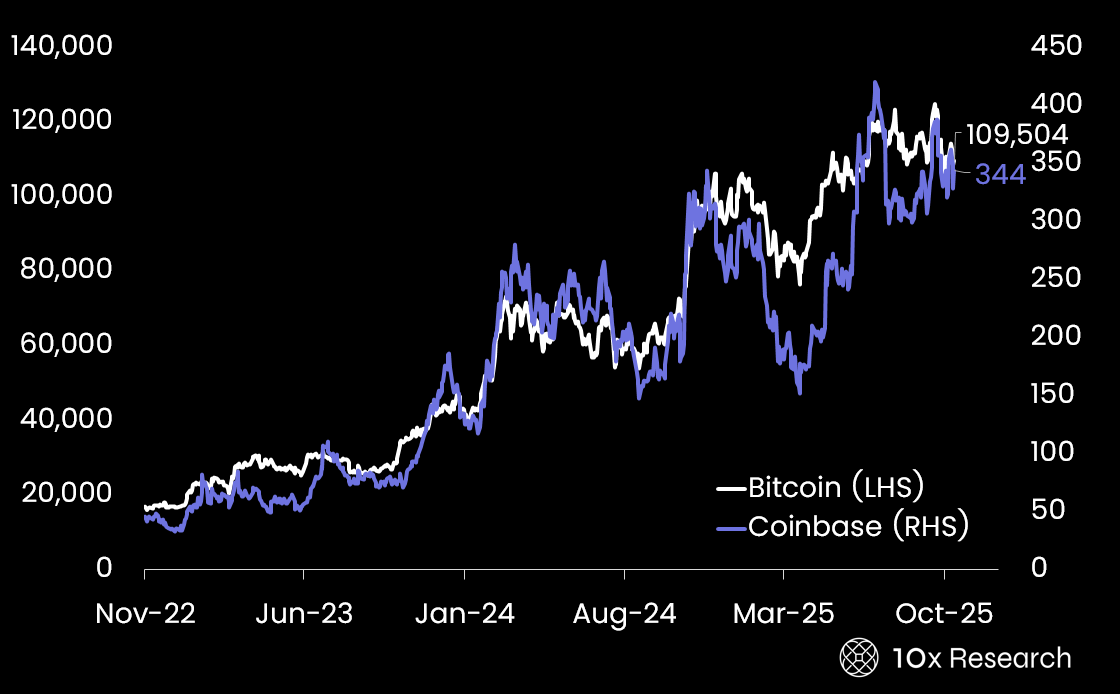

Crypto markets are sending a very different signal beneath the surface, and it’s not the one most investors are trading on. Bitcoin has outperformed Coinbase by a wide margin since early 2024, yet options markets are now pricing COIN as the higher-risk asset. That disconnect has quietly opened one of the most compelling spreads we’ve seen this year, the kind professionals exploit long before the public notices.

Bitcoin (LHS) vs. Coinbase (RHS)

Meanwhile, ETF flows, Fed expectations, and on-chain activity are shifting in ways that could reprice crypto risk far faster than spot charts imply. Most traders are still focused on direction; the smart money is already positioning around pricing distortions and asymmetry. If you understand why this matters now, you’ll see a trade others won’t understand until it’s already played out.

Main argument

Our Coinbase calls this year have been well-timed. In May, we highlighted COIN’s undervaluation relative to Bitcoin, as the stock traded near $199 while BTC was at $103,000, a dislocation that later closed as COIN rallied to $344. We then flagged overvaluation on July 22, 2025, at $414, noting stagnant crypto trading volumes and the risk of multiple compressions; the stock subsequently retraced to $300.

Our core thesis at the time was that pricing momentum had outpaced underlying activity, and Coinbase had entered an overextension phase beginning in late June. While the momentum around the GENIUS Act and the successful Circle IPO supported a rally, with COIN positioned as a structural beneficiary, the stock traded broadly sideways from June onward, mirroring Bitcoin’s consolidation.

Following Coinbase’s Q3 2025 results and growing optimism around U.S. crypto-market structure reform (post-government shutdown), investors are asking whether COIN can regain momentum into year-end. But this setup isn’t about calling the next move, it’s about exploiting a pricing dislocation. Right now, an unusual trading insight allows traders to structure exposure that effectively delivers a “free” Bitcoin upside call.