False Signals, Real Breakouts: Why Bitcoin’s Next Move Won’t Come From Macro Narratives

Actionable Market Insights

Why this report matters

Markets love simple stories, but Bitcoin rarely follows them. While U.S. equities benefit from powerful early-year seasonal flows, Bitcoin plays by different rules. Calendar effects fade, macro correlations weaken, and the signals that matter most often hide in market structure, technical resets, and capital behavior. As we move into 2026, many widely followed macro indicators are flashing confidence, yet history suggests they are least reliable precisely when conviction is highest. The real question isn’t whether liquidity is rising. The question is whether real capital is positioning for the next regime shift.

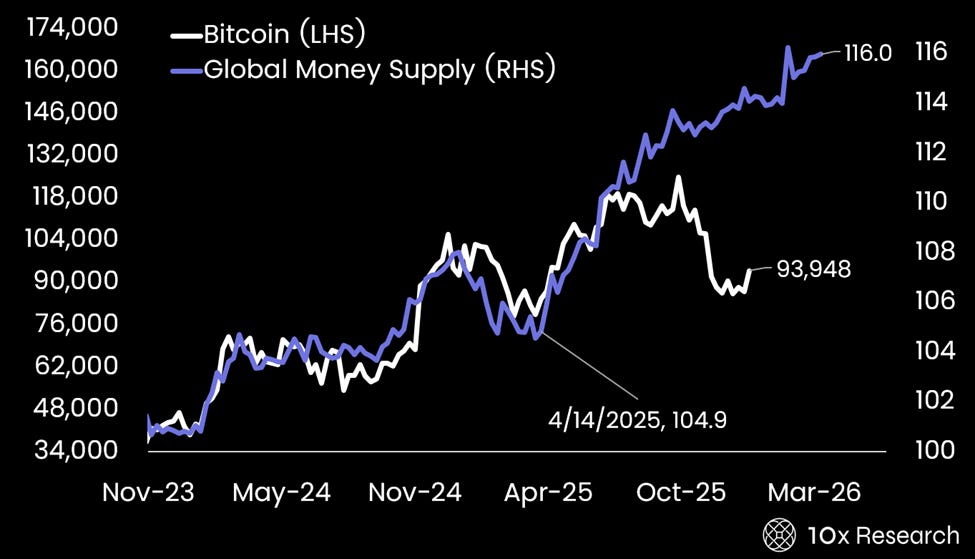

Bitcoin (LHS) vs. Global Money Supply (RHS)