Forever wars, forever Bitcoin.

The Bigger Picture.

Forever wars, forever Bitcoin.

Politicians love to promise ahead of elections that taxes won’t rise and that tax cuts will somehow pay for themselves. Most voters see through these empty assurances, yet the same tactics are repeated—with consequences that can be devastating. History reminds us that wars bring collapsing living standards, inflation, and stalled economic growth. Both World Wars were catastrophic, but the Thirty Years’ War of the 17th century was arguably worse, condemning generations to a lifetime of conflict. Today, while battlefields shift every few years and remain largely distant from the Western territories, we are effectively in the midst of a modern “rolling Thirty Years’ War”—stretching from the 1990s through Iraq, Afghanistan, Syria, Ukraine, and perhaps one day, Iran.

While casualties in wealthy Western nations have been limited, trillions of dollars have nonetheless been spent with little to show for it. Far from improving conditions, these wars have drained government resources, leaving U.S. and European taxpayers to shoulder enormous costs for conflicts engineered or supported without clear outcomes.

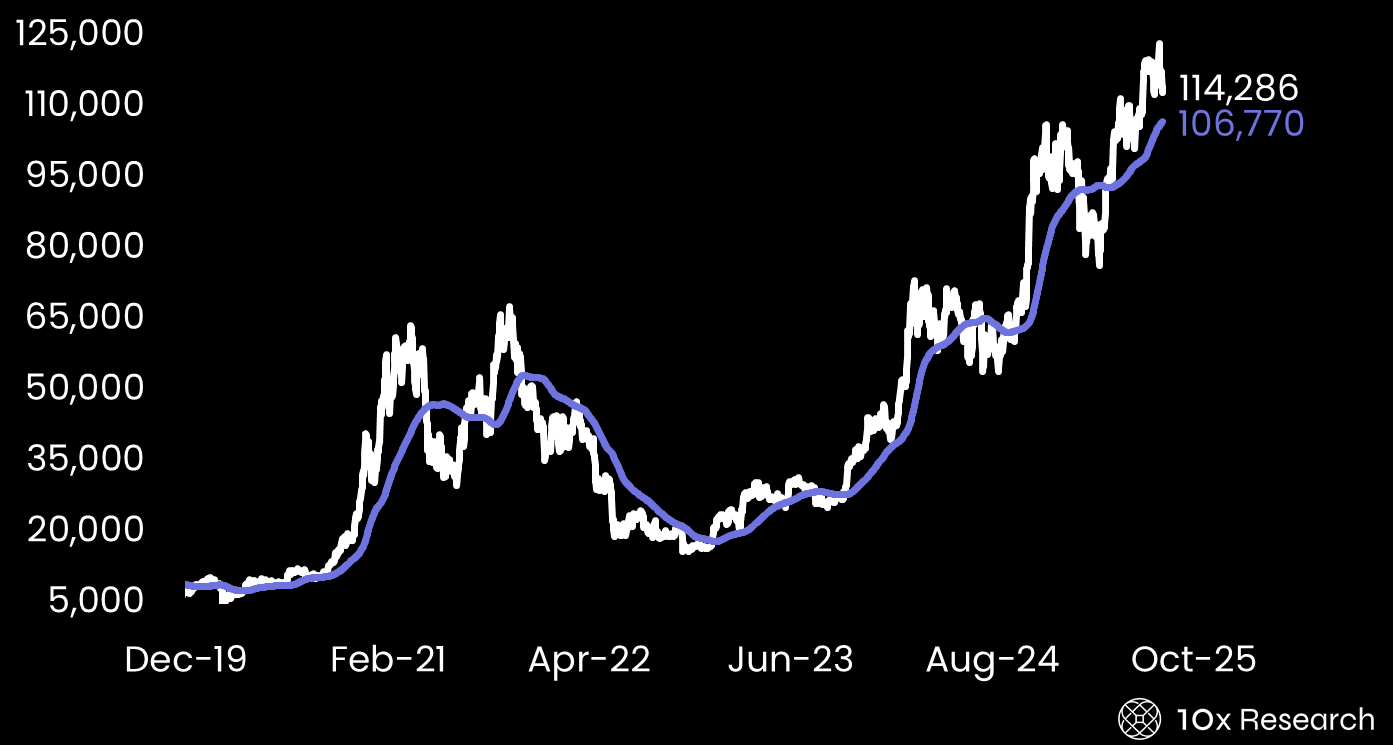

The war in Ukraine alone has dragged on for three and a half years with no decisive progress, yet the U.S. and Europe have already funneled more than $300 billion, adding directly to already swollen debt burdens. Ultimately, this debt will translate into higher taxes, persistent inflation, or both, while economic growth concentrates in ever fewer hands. With global growth rates too weak to offset these liabilities, the ongoing debt explosion is likely to keep a structural bid under Bitcoin for the foreseeable future.

Bitcoin