Galaxy Digital Loses Hundreds of Millions — Is the 17% Sell-Off Justified or a Buying Opportunity

Actionable Market Insights

Why this report matters

Galaxy Digital just released its Q4 2025 earnings, and the results highlight a broader, telling shift across the crypto equity landscape. Despite its status as an industry bellwether, Galaxy has generated little sustained alpha. While the market began pricing in a valuation premium around October 2025, the key question now is whether that premium persists, compresses, or expands. The answer carries meaningful implications for the stock; investors signaled their skepticism by selling shares down 17%.

More broadly, Galaxy’s earnings call underscores a growing divergence between winners and losers within crypto equities. This is no longer a single-beta trade. We have a clear view of which side of that divide Galaxy sits, and whether the recent sell-off marks the start of a deeper downtrend or a mispricing that the market may ultimately correct.

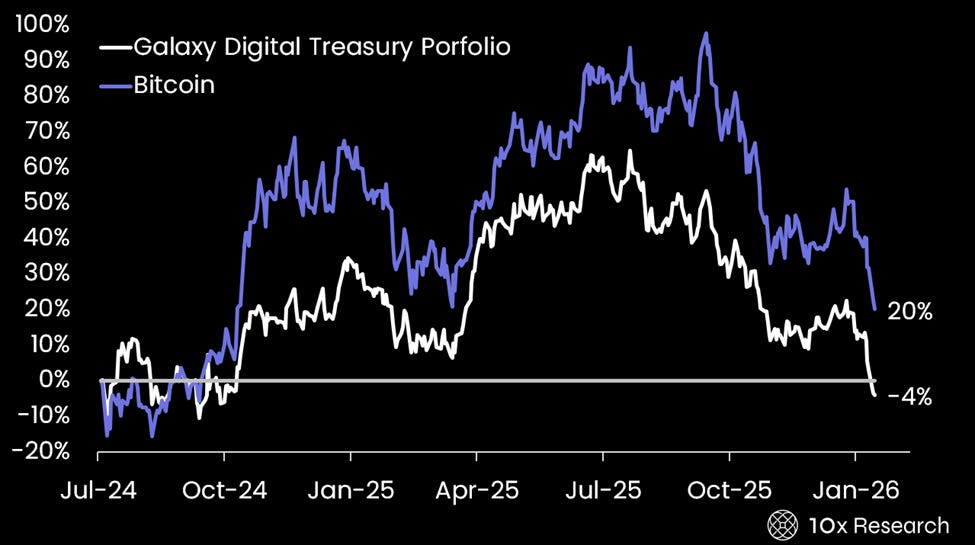

Bitcoin vs. Galaxy Digital Treasury Holdings (approx. based on current holdings)