How Coinbase Really Makes Its Money — And Why Its Valuation Could Surprise You

Actionable Market Insights

Why this report matters

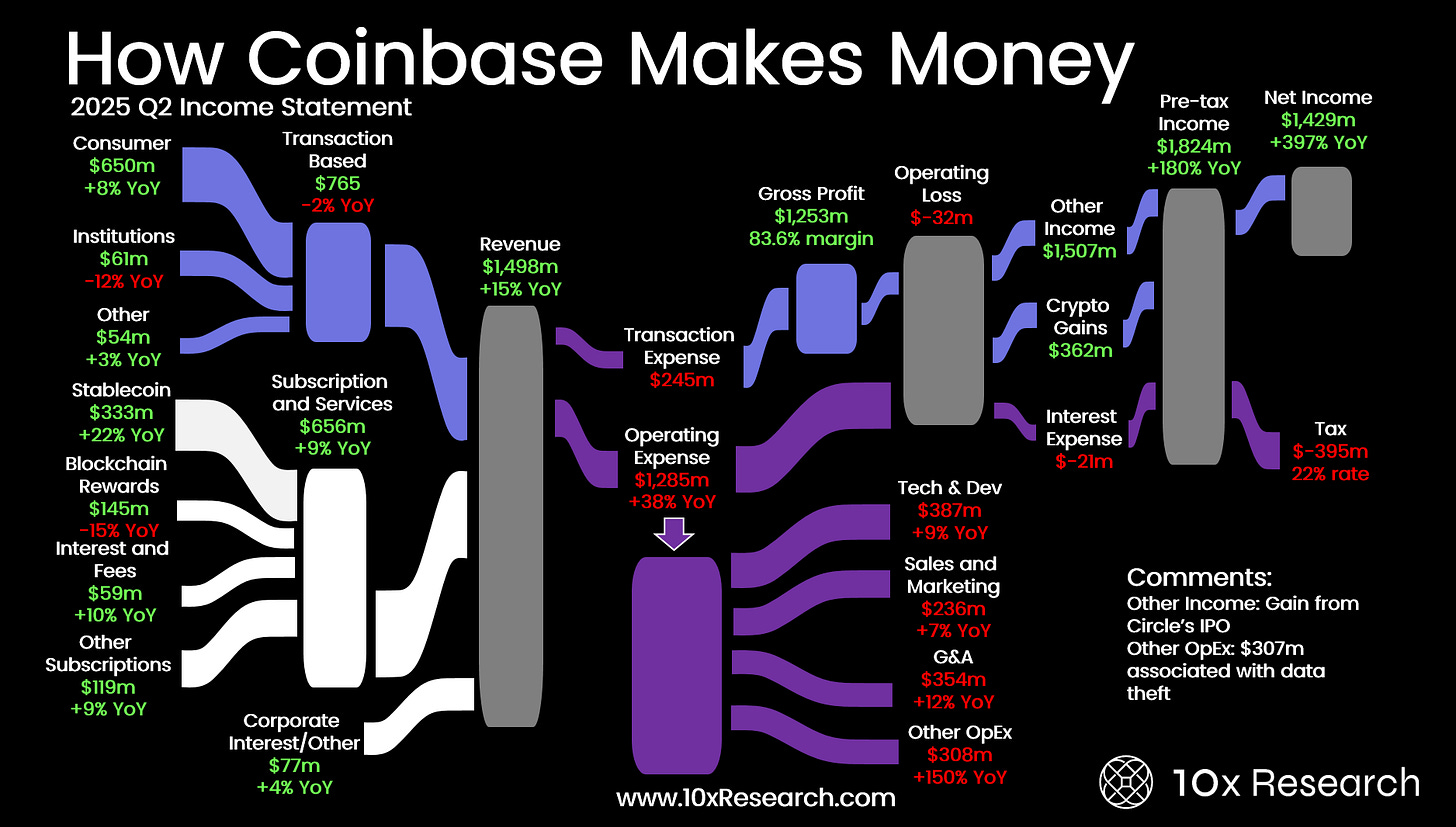

Valuing Coinbase was once straightforward—now it’s anything but. Analysts are calling for +20% upside, but is that outlook truly justified? Coinbase posted $1.4 billion in net income last quarter—but the real question is, how sustainable is that performance? Coinbase has been stuck around $300 for weeks, but beneath the surface, the forces driving its valuation are shifting fast.

Stablecoin revenue is growing, yet one-off gains like Circle’s IPO have masked deeper vulnerabilities. Circle’s stock has dropped sharply, volumes have cooled, and heavy capex spending looms just as transaction revenues stall.

Meanwhile, derivatives markets are pricing in a 10% move by October, but with an implied volatility of 50%, conviction is low. The real question is whether the swing factors, Circle’s mark-to-market, crypto volumes, and Bitcoin’s path, tilt Coinbase toward profit or loss?

How Coinbase makes money

Main argument

Although we turned bullish on Coinbase in early May, by June 27, 2025, with shares trading near the upper bound of our valuation model at $375, we shifted to a bearish stance (here) with a $300 target. Historically, these valuation frameworks have been highly reliable, and with the right tools and timely calls, they’ve consistently delivered profitable opportunities. That said, there is still another factor that must be considered in assessing whether Coinbase shares are truly overvalued or undervalued.