Indeed, Bitcoin Is Leaving Hesitant Traders Behind

Actionable Market Insights

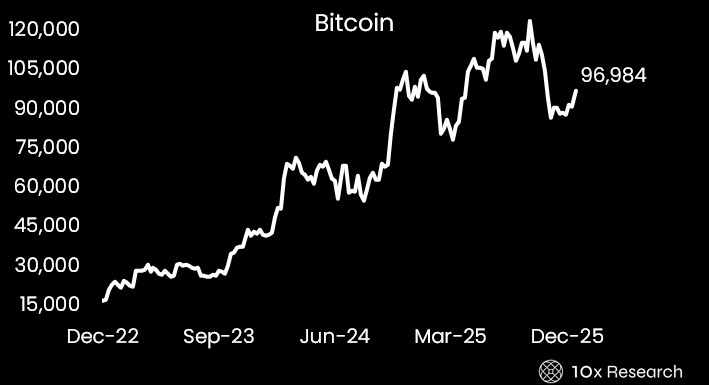

Bitcoin is now up more than 10% since we highlighted on December 26 that a multi-week rally was likely, based on our indicators, even though it was a highly contrarian call at the time (see December 26, 2025: Is Bitcoin Quietly Setting Up a Multi-Week Move? Here’s the Trade). We had already turned bearish well ahead of consensus in late October and, once again, moved decisively ahead of the crowd as sentiment shifted toward claims that 2026 would be a Bitcoin bear market.

The strength of this rebound has caught many traders off guard. Our crypto-stock trading signals from January 2 have advanced by +14% to +23% in just two weeks, reinforcing our long-standing view that missing sharp 10%+ moves, even in a challenging or uncertain market, can be costly (here).

Bitcoin - how durable is the rebound? Let us explain…

Importantly, this shift was well telegraphed. On December 31, we published a Quick Technical Update on Bitcoin, highlighting that our indicators were turning toward a tradable rally (here). On January 4, we explicitly noted that seasonality was turning, a historically constructive signal (here). By January 5, in New Setups Are Emerging Quickly, we showed that several altcoins had transitioned into constructive bullish formations (here).

While many of these insights were delivered through our Trading Signals publication, we also ensured that Market Updates subscribers were fully positioned for the rebound, first by highlighting the December 26 buying opportunity near $88,000, and again in our January 4 report, Don’t Miss the Next Move in Bitcoin, Ethereum, Solana, XRP, and BNB (here).

The key question now is whether this rally proves durable, supported by genuine fundamentals and meaningful shifts in the crypto market structure.