Is Coinbase Running Too Hot After Its 88% Rally?

Actionable Market Insights

Why this report matters

Coinbase has surged 88% since mid-May, far outpacing Bitcoin, trading volume, and nearly every crypto stock in its peer group. But do fundamentals still back this move, or are we entering a zone of overexcitement? Our latest analysis delves into valuation signals, retail inflows from Korea, and what is truly driving the disconnect between Coinbase and the broader cryptocurrency market. One simple regression model explains 75% of the stock’s price action, and it’s flashing a potential warning. Meanwhile, sentiment is cooling in other crypto favorites, such as Circle and KakaoPay.

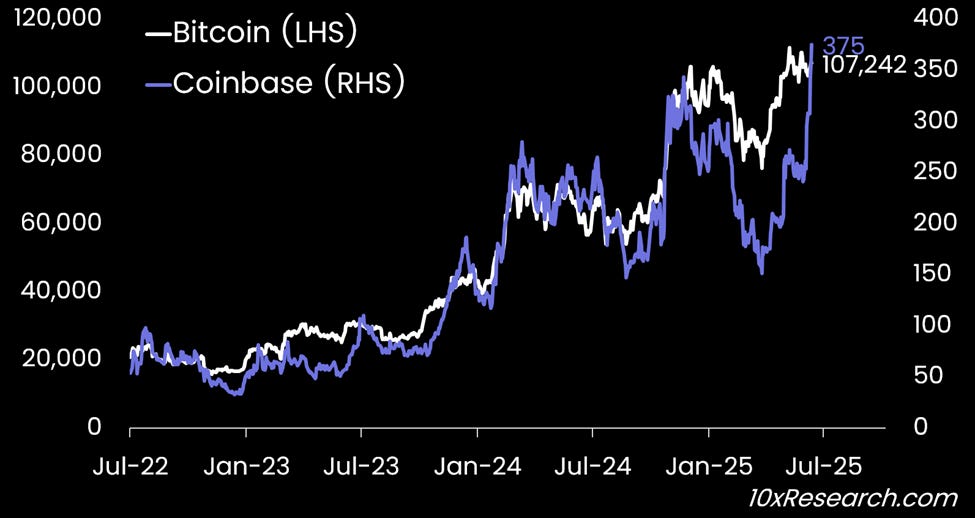

Bitcoin (LHS) vs. Coinbase (RHS)

Main argument

We’ve maintained a bullish view on Coinbase, with our valuation trigger aligning with its inclusion in the S&P 500, announced on May 19, when the stock was trading at $264. In our May 12 market report, we highlighted a significant divergence between Bitcoin and Coinbase’s share price, with COIN trading at $199 while Bitcoin stood at $102,971.

At the time, our regression model indicated that Coinbase was undervalued by 32%, near historical lows. Even in our June 8 update, the model still indicated that Coinbase was trading 18% below fair value, and we noted its strong positioning as a key beneficiary of Circle’s growing stablecoin business.