Is the Gold, Silver, and Bitcoin Repricing Finally Over? Here’s What Traders MUST Focus on Next

Actionable Market Insights

Why this report matters

Markets don’t usually give clean second chances, but when they do, they rarely announce them loudly. Over the past 72 hours, gold, silver, and Bitcoin were hit by a rare combination of insider-driven repricing, macro shock, and forced liquidation, pushing them sharply lower. Panic peaked during Asian hours. Headlines turned uniformly bearish. Protection became expensive.

And then something changed.

For our Trading Signals subscribers, this was not a surprise. Shortly before the intraday low, we flagged that crash protection was overpriced as Bitcoin approached strong support and outlined a tactical positioning approach for a rebound. This report explains why that setup emerged, what shifted under the surface, and how to think about the next move, before the market consensus catches up.

If you’re relying on headlines or waiting for confirmation, you’re likely already late. This is the phase when risk-reward quietly shifts, volatility compresses, and disciplined positioning matters most, as we explain below.

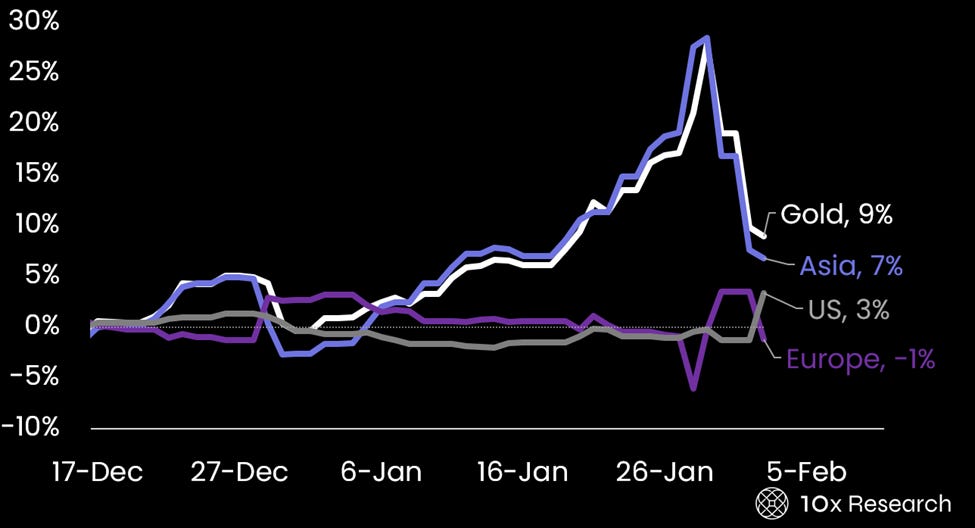

Gold rally driven by Asia? And the gold crash is also driven by Asia?