Kakaopay: The Hidden Risk Lurking in Korea’s Stablecoin Boom

Actionable Market Insights

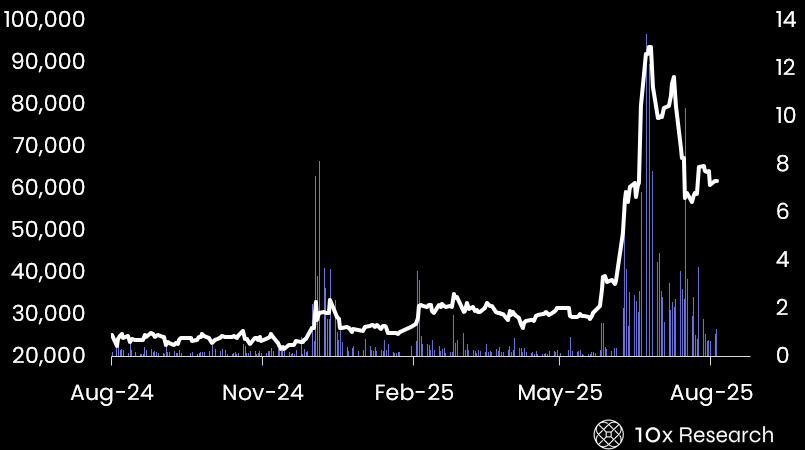

In our June 27 report, we highlighted weakening momentum across several crypto-related stocks, including South Korea’s Kakaopay. Since then, the impact has been clear—Kakaopay has declined 28%. In June, eight of South Korea’s largest banks formed a consortium to develop a KRW-denominated stablecoin. KB Kookmin Bank has already filed 32 trademarks tied to won-based stablecoins and another 49 linked to foreign currency-backed versions. While the Digital Asset Basic Act does not explicitly prohibit non-banks from issuing stablecoins, Bank of Korea Governor Rhee Chang-yong has made it clear that he expects commercial banks to lead this initiative. Kakaopay was among the biggest beneficiaries of the stablecoin hype—until the Bank of Korea poured cold water on the idea of tech firms issuing freely circulating stablecoins.

While regulatory progress will continue, significant restrictions now seem likely, mirroring the U.S. stance. Banks may emerge as the main winners, while firms like Kakaopay could be left with only limited upside. As Korean lawmakers and central bankers tighten the rules, the company’s growth story may be approaching an inflection point. Retail enthusiasm has fueled the rally, but fading volumes and summer fatigue point to waning momentum. With valuations stretched and policy risk rising, the tide could be turning. Shares in Kakaopay could potentially decline by -34%.

Kakaopay (LHS) vs. its trading volume (RHS)

Main argument

South Korea’s proposed stablecoin licensing bill was introduced on June 10, 2025, by ruling Democratic Party lawmaker Min Byeong-deok as part of the broader Digital Asset Basic Act. Just days later, on June 18, the Bank of Korea governor expressed cautious support for won-pegged stablecoins, while warning about potential risks to the country's foreign exchange policy. His deputy later echoed this stance, suggesting a phased rollout of stablecoins through regulated banks. Roughly one-third of South Korea’s 52 million citizens invest in digital assets, with dollar-backed stablecoins proving especially popular—over $19 billion was moved offshore via these assets in just the first quarter of this year. In response, the Bank of Korea has called for a cautious, phased rollout of stablecoins. A formal review of the proposed legislation is scheduled for August, reflecting growing concerns over capital flight and financial stability.