Mastering 2026 Starts With Being Prepared

Actionable Market Insights

Two years ago, the team at Lookonchain, a leading crypto analytics firm with more than 677,000 followers on X, shared an independent review of our work with us. After reviewing reports line by line across many leading crypto research providers, they concluded that our 10x Research analysis was the most accurate among the major crypto voices they track.

Notably, in late October 2022, when Bitcoin was trading near $18,000, we identified the likely bottom of the bear market and outlined the conditions for a powerful rally. At the same time, we highlighted select altcoin opportunities, including Solana, around $13.70, well before sentiment and capital flows began to turn.

About a year ago, CryptoQuant, a leading on-chain analytics firm with more than 285,000 followers on X, together with its founder, Ki Young Ju (425,000 followers), noted that 10x Research was the most frequently quoted crypto research firm by major global crypto media.

Throughout 2023 and 2024, we appeared regularly on television to discuss our outlook, consistently highlighting the potential for substantial upside, even as many hosts and commentators remained skeptical.

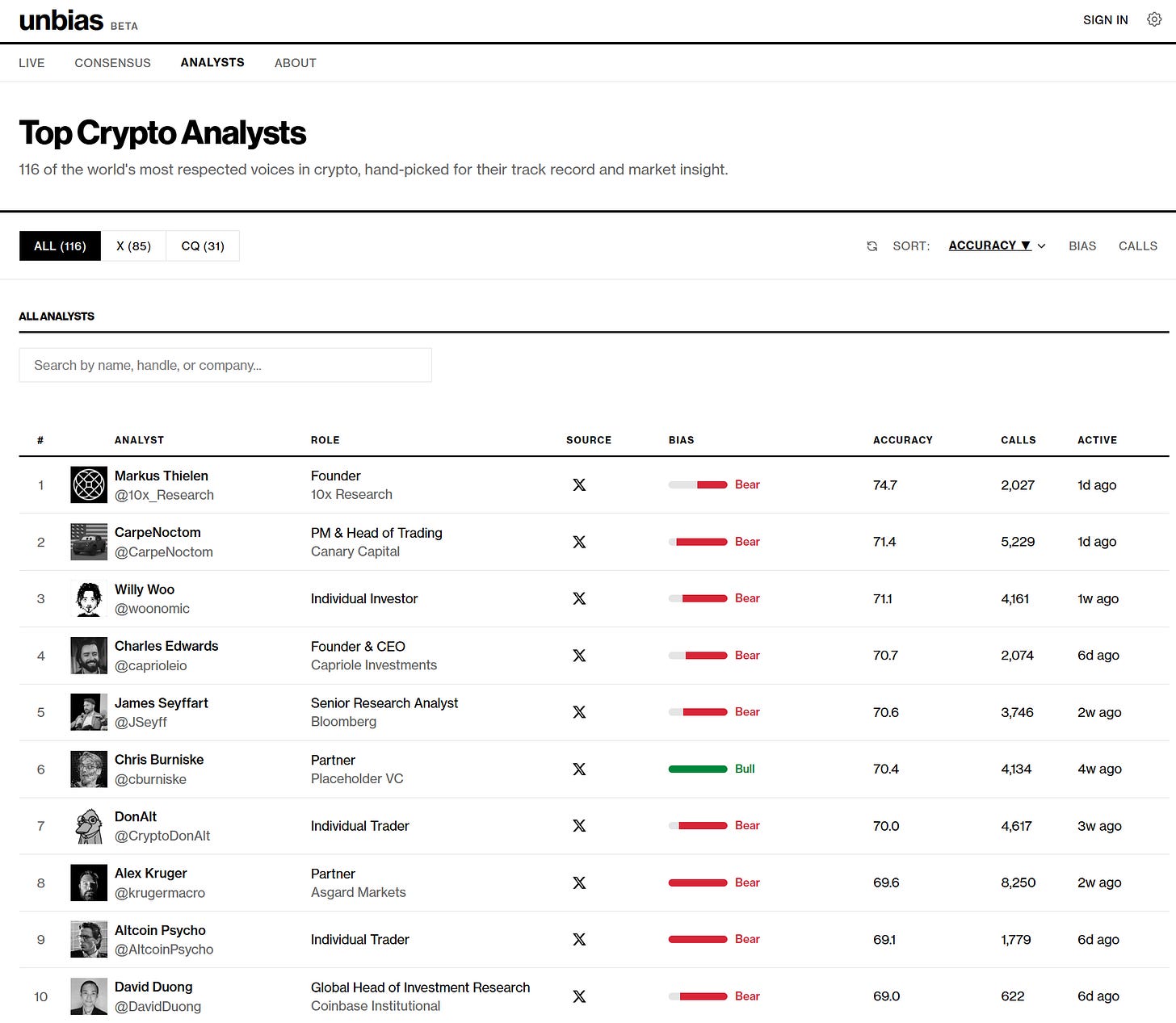

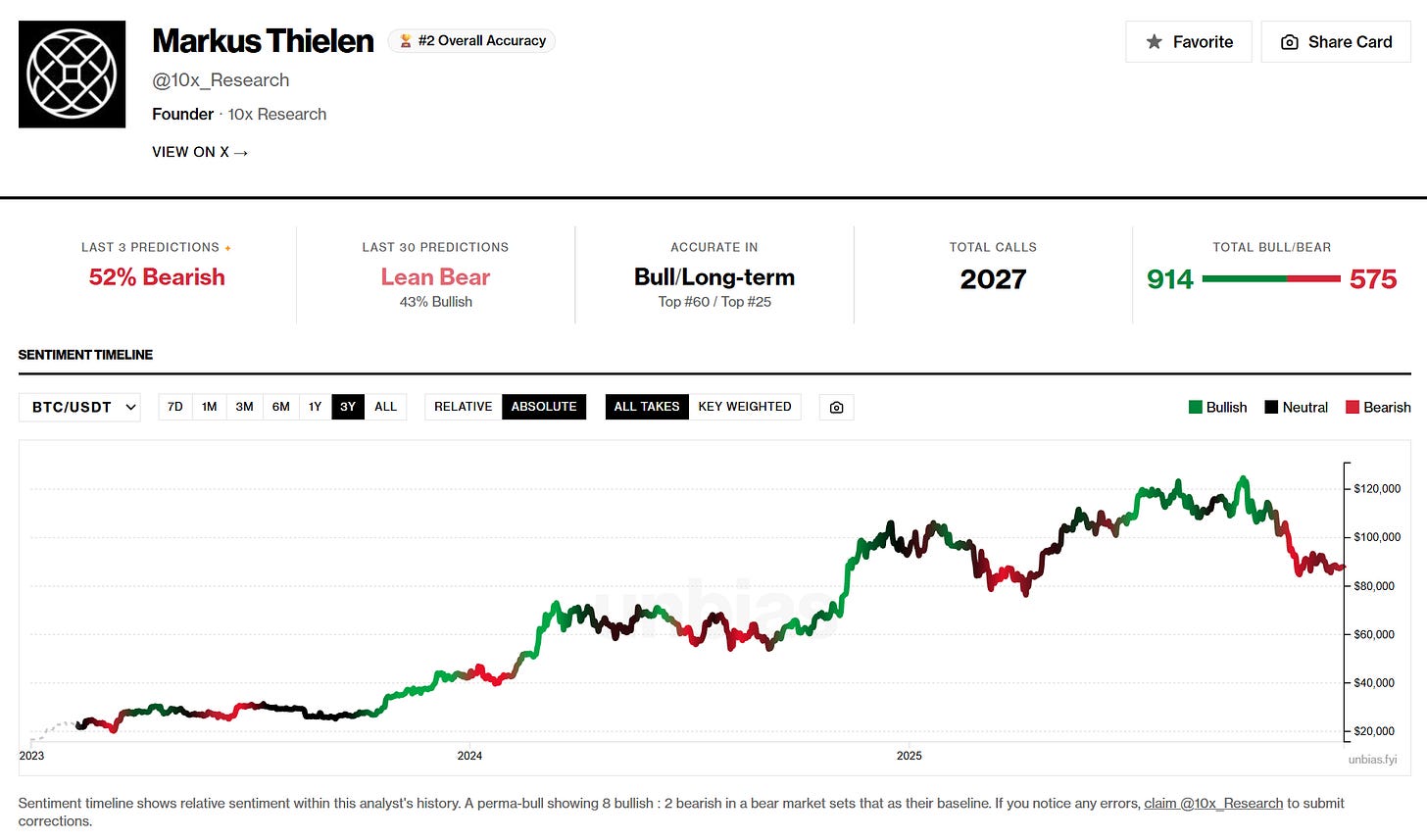

The team at CryptoQuant has recently released a beta version of its analyst rankings, covering 116 of the world’s most respected crypto voices, selected for their track records and market insights. While our 10x Research research is distributed primarily behind a paywall (here) and reserved for subscribers, CryptoQuant appears to have inferred our directional views from our published commentary and market calls, ranking 10x Research as the No. 1 analyst in its initial release.

Our work is fully independent and free from the corporate incentives that often influence sell-side research. We aim to present the most realistic and actionable market view possible, fully acknowledging that no framework is perfect and not every call will be correct. That said, our strongest contributions have often come ahead of or against consensus.

For example, while sentiment turned broadly bullish in February following the Trump inauguration, we warned that Bitcoin was breaking down (report), a move that later played out into the tariff-driven sell-off. By mid-April, we identified the conditions for a bullish upside breakout (video). By summer, as enthusiasm around the U.S. GENIUS Act peaked, we highlighted persistent legacy-wallet selling that kept Bitcoin range-bound (video). In late October, we turned bearish again (video), even as year-end price targets across the market grew increasingly optimistic.

What differentiates 10x Research is our holistic framework that integrates on-chain analytics, technical analysis, macroeconomic conditions, quantitative signals, market structure, sentiment, and narratives. These inputs rarely align at the same time; the edge lies in knowing which signals matter most, and when.

It has also helped that, for many years, we have managed capital for leading hedge funds across both macro and crypto markets. That experience forces us to think first and foremost in actionable trading terms, because research only matters if it leads to better decisions in real portfolios.

The year ahead will not be easy. We are not here to sell the illusion of effortless, life-changing returns to retail investors. Markets are rarely about being simply bullish or bearish; more often, they are about probabilities, risk management, and making consistently smart decisions. No simple algorithm can capture that nuance.

Our research is designed for investors who want to stay ahead of the crowd, not chase it, and those who understand that timing, positioning, and context matter more than headlines.

Early in my proprietary trading career at J.P. Morgan, a senior trader told me something that has stayed with me: the market opens every day. Missing an opportunity today is not a failure; there will be others tomorrow. Even when the outlook appears bleak, opportunities always emerge. That will be just as true in 2026.

As we look toward 2026, one message should be clear: our subscribers are in good hands. We have navigated multiple market regimes, bull markets, bear markets, and long periods of uncertainty by staying disciplined, independent, and grounded in data rather than narratives. That approach will matter even more in the year ahead.

2026 is unlikely to reward complacency or simple directional bets. It will demand probabilistic thinking, risk management, and timing, not blind optimism or fear. Our commitment is to continue delivering research that is not only thoughtful and independent, but actionable, helping you anticipate shifts in market structure rather than react to them after the fact.

We will continue to do what has defined 10x Research: synthesizing on-chain data, macro signals, quantitative models, market structure, sentiment, and narratives, while knowing when each deserves priority. Markets open every day, opportunities recur, and our role is to help you stay prepared, patient, and positioned.

Thank you for trusting us. We remain fully committed to helping you navigate complexity, stay ahead of the crowd, and master 2026, one decision at a time.