Only 3 Things Can Stop This Crash Now

Institutional Crypto Research Written by Experts

👇1-23) Trump’s tariff strategy appears less about fostering broad negotiations and more about setting a minimum price for foreign companies to access the lucrative U.S. consumer market. The goal is to enrich the U.S. government. Still, in a time of rising uncertainty and slowing global growth, it’s unlikely that international firms will pivot away from their domestic priorities to make major U.S. investments.

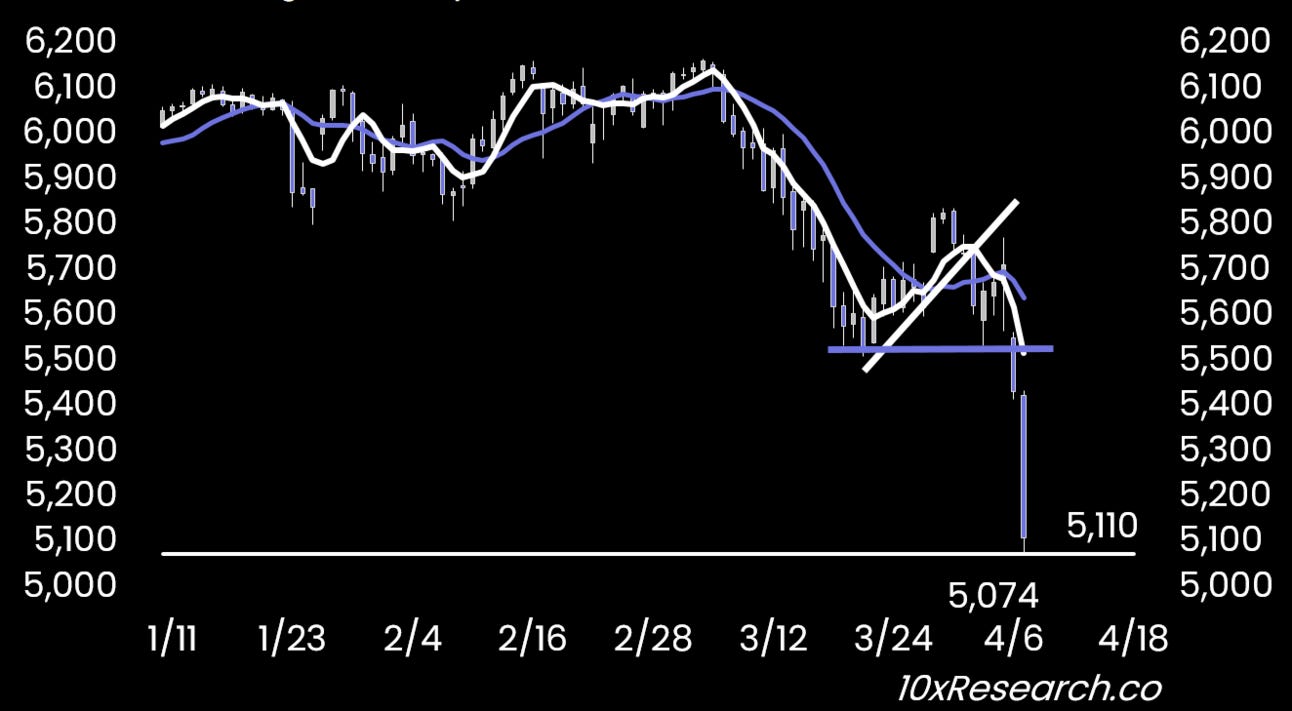

SP500 broke two critical levels (white mini uptrend) and support (purple)

👇2-23) A significant economic slowdown now seems likely, with consumer spending poised to decline as job security weakens—pressured not only by automation and AI, but also by long-term structural shifts such as China’s “Made in 2025” plan, which continues to reshape global auto production and other industries.

👇3-23) The economic data aligned with our expectations, reflecting sentiment before the tariff announcement—but already signaling slowing growth and early signs of labor market softness. While the stronger-than-expected nonfarm payrolls report gave Fed Chair Powell the cover to remain on hold, we believe the Fed will likely stay patient in its fight against inflation. Despite markets pricing in four rate cuts, we expect no meaningful policy shift until the labor market shows more pronounced weakness—something that may require at least two more employment reports.