Our Top Crypto Stock Jumped 19.6% in 3 days, Will Bitcoin Follow With a Squeeze?

Actionable Market Insights

Why this report matters

Bitcoin may look quiet on the surface, but the options market is flashing signals that few are paying attention to. Flows have shifted dramatically, with traders selling volatility and positioning as if nothing is about to happen. At the same time, key players who once drove demand are constrained, while new winners are beginning to emerge.

The divergence between NAV compression, stablecoin adoption, and liquidity tailwinds is setting up an environment unlike anything we’ve seen this year. What appears as consolidation may, in fact, be the calm before a sharp rotation. The question is: who will be on the right side of the next move?

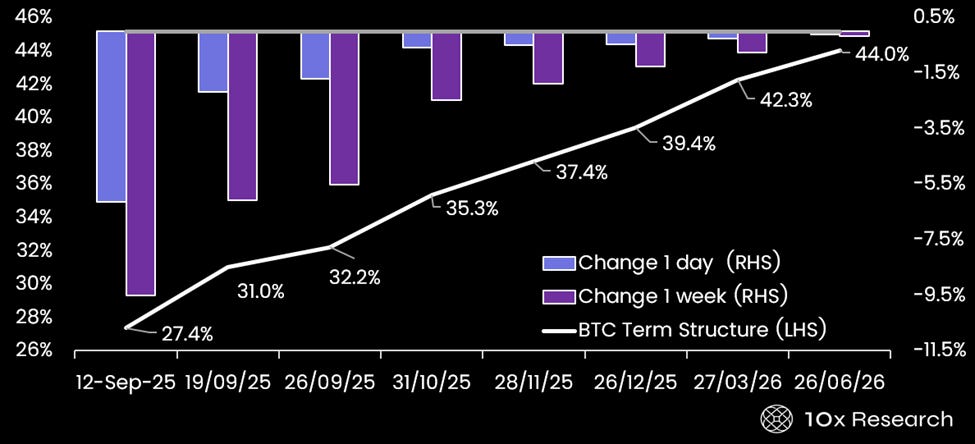

Bitcoin Implied Volatility (LHS) sharply reprices lower (RHS)

Main argument

Bitcoin is never boring, and sentiment can shift in an instant. The breadth of available data makes crypto markets fascinating to analyze, offering a clear information edge much like in traditional markets. The difference is that, unlike the gated flow dynamics of market makers and brokers, most crypto data is publicly accessible—it simply comes down to having the right access (often pro paid versions) and the ability to piece it together accurately and in time.

Bitcoin and Ethereum options have undergone a notable bullish repricing following Wednesday’s softer-than-expected PPI and Thursday’s in-line CPI release. Markets are now pricing in three cuts for this year. Front-end implied volatility collapsed, falling by 6% for BTC and 12% for ETH on the September 12 expiry, with the entire term structure shifting lower.