Prediction Markets Aren’t Efficient — How We Generated 154% Annualized Returns in 2025

Actionable Market Insights

Why this report matters

Most traders think prediction markets are already “solved” by bots. That assumption is wrong and costly. Polymarket and Kalshi raised over $3 billion in Q4 2025, yet crypto markets on these platforms remain thin, inefficient, and mispriced. While Crypto Twitter circulates screenshots of a few standout accounts, almost no one explains how those returns are actually generated, or whether they can be replicated.

We didn’t use bots or insider access. We traded a repeatable, rules-based strategy that anyone can implement with discipline and active capital management. The real questions investors should ask are simple: Is the liquidity real, or just inflated? Which strategies actually work on Polymarket? Can this scale beyond small retail bets?

In our latest report, we break down how we generated 154% annualized returns in 2025 and outline our playbook for 2026, including what works, what doesn’t, and where the edge still exists.

👉 Read the full report if you want to understand where prediction markets are still inefficient.

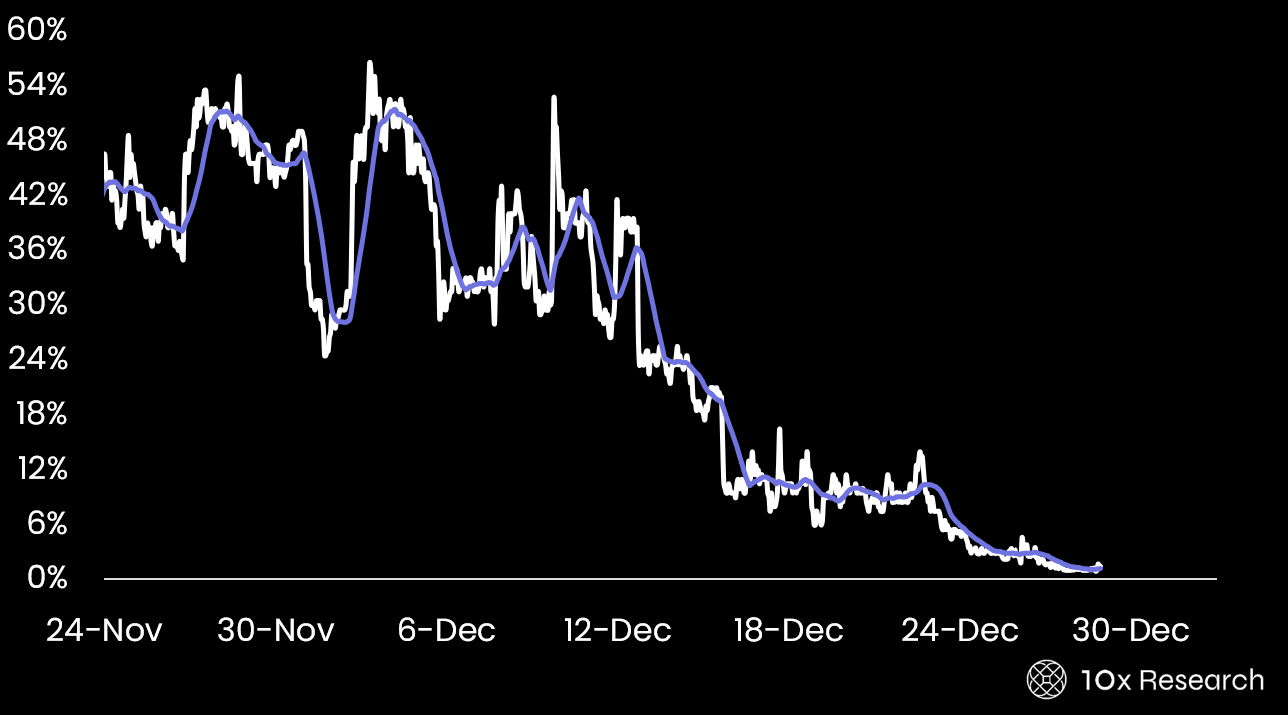

Probability of Bitcoin reaching $100,000 by December 31