Prediction Markets: The Next Structural Arbitrage Arena Bitcoin Traders Can’t Ignore? (Part 1 of 3)

Actionable Market Insights

Why this report matters

For some, prediction markets represent a gamified extension of financial trading; for others, they sit uncomfortably in a regulatory grey zone between wagering and market making. Although operators consciously avoid being labeled as (sports) betting platforms, that category still drives the majority of volume, while niche markets, including Bitcoin and crypto outcomes, offer targeted opportunities.

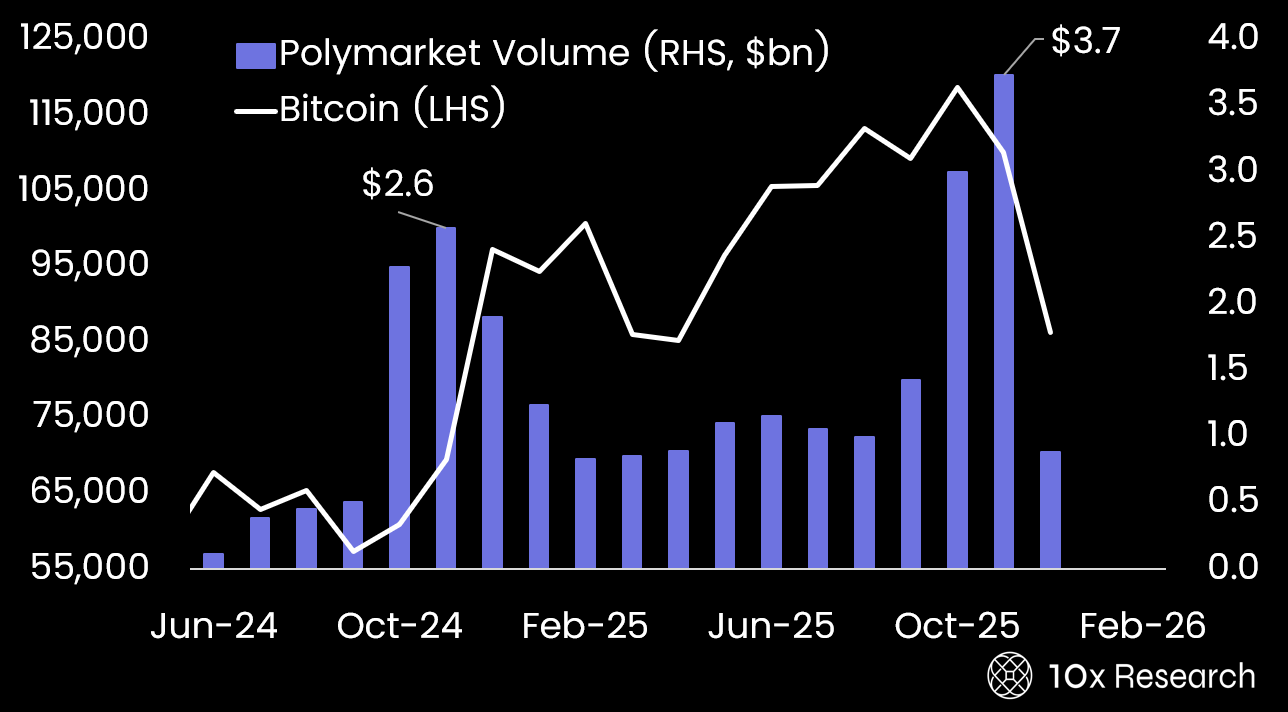

Bitcoin (LHS) vs. Polymarket monthly trading volumes (RHS, $ billions)

These markets often pit casual retail participants against highly informed, data-driven traders, which can create extreme information asymmetry and meaningful arbitrage windows. It is a valuable reminder that nearly every major crypto trading venue operated its own market-making or “treasury” desk, not just to provide liquidity, but to stand on the other side of retail flow, and rarely at a loss.

We have spent time dissecting this landscape, developing ten core rules for navigating it, and identifying trades that justify real capital deployment. Broader frameworks and structural insights will be shared in subsequent reports.

Main argument

I remember Arthur Hayes presenting to professional traders in 2015 in Hong Kong, highlighting the retail-driven inefficiencies his leveraged crypto exchange had unlocked. Korean retail traders were paying implied funding rates near 200% to buy Bitcoin futures, and his crypto exchange, Bitmex, simply needed ‘professional’ flows to sell into that demand. The edge wasn’t directional; it was structural: capture the spread without caring where Bitcoin traded.

A few years later, the same dynamic reappeared with the Grayscale GBTC trust, where retail buyers, largely accessing it through OTC brokerage platforms, pushed the product to premiums of 100%+ over NAV. Institutions could subscribe to GBTC at par, hedge Bitcoin exposure immediately on day one, wait out the six-month unlock, and exit directly into retail excess.

But there are countless examples of professional crypto desks trading directly against retail flows, and whenever structural mispricings emerge, those who understand the mechanics capture them first. With prediction markets poised to expand significantly in 2026, this felt like the right moment to take a closer look, before liquidity deepens and the easy edges disappear.

Please read below Part 1 of our three-part series.