Tactical Bitcoin Bearish as MicroStrategy’s retail extraction strategy takes a pause.

Actionable Market Insights

Why This Report Matters

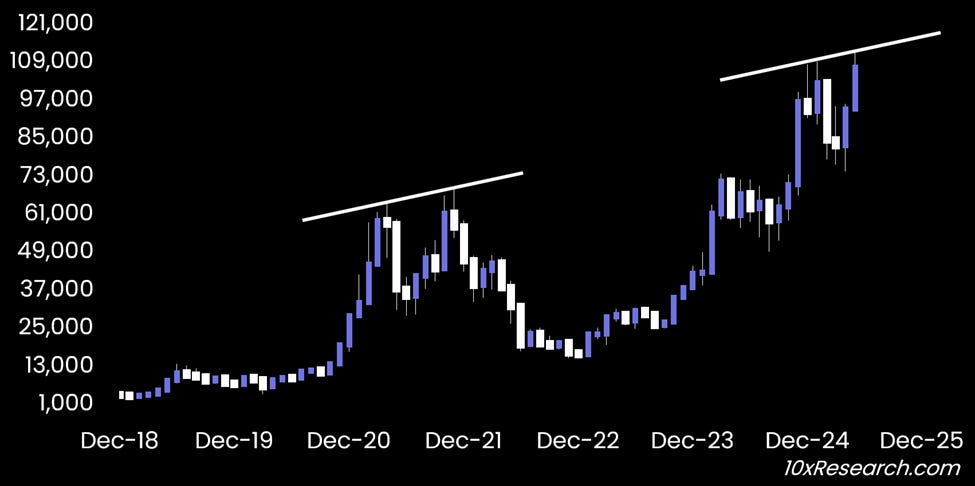

Bitcoin just posted another strong month, but beneath the surface, cracks are forming. A growing divergence between price action, volatility, and retail behavior suggests the cycle may be shifting. Major players, such as MicroStrategy, are slowing their purchases, and key altcoins are slipping below critical support levels. Volumes are fading, momentum is fracturing, and the technical signs are eerily similar to what we saw in 2021, just before things turned.

Main Arguments

We took a contrarian bearish stance on Bitcoin back in February and were also among the first to rejoin the rally in early April. However, after a 25% move higher, we turned bearish again last week, initiating a put spread trade idea on MicroStrategy. We followed up on our report, “10 Bearish Signals Bitcoin Bulls Are Ignoring Right Now,” and with Bitcoin now struggling to hold the $106,000 support level, our timing appears well-aligned once again.

Bitcoin is running into similar technical resistance as in 2021

Key developments in MicroStrategy’s NAV, declining trading volume, and—critically—falling volatility may be early signs that this gravy train is running out of steam. Our “10 Bearish Signals” report remains highly relevant and could help preserve valuable capital—capital that can be redeployed into Bitcoin once the market bottoms.