Tariff Turmoil: Where Does Bitcoin Go From Here?

Institutional Crypto Research Written by Experts

Topics covered: bitcoin, tariffs, Trump, Fed, ISM, derivatives, options, VIXViews: short-term, medium term, trading strategy/expectation around tariffs for bitcoin👇1-14) U.S. President Trump has announced a new wave of tariffs targeting America’s trading partners. While equities have pulled back, the reaction in implied volatility has been relatively contained, indicating that markets do not view this as a full-blown risk-off event.

👇2-14) The VIX index, a key gauge of investor fear derived from options pricing, has risen to 23.5%, still well below the 36% peak seen in early August 2024 when recession concerns spiked amid signs of a weakening labor market.

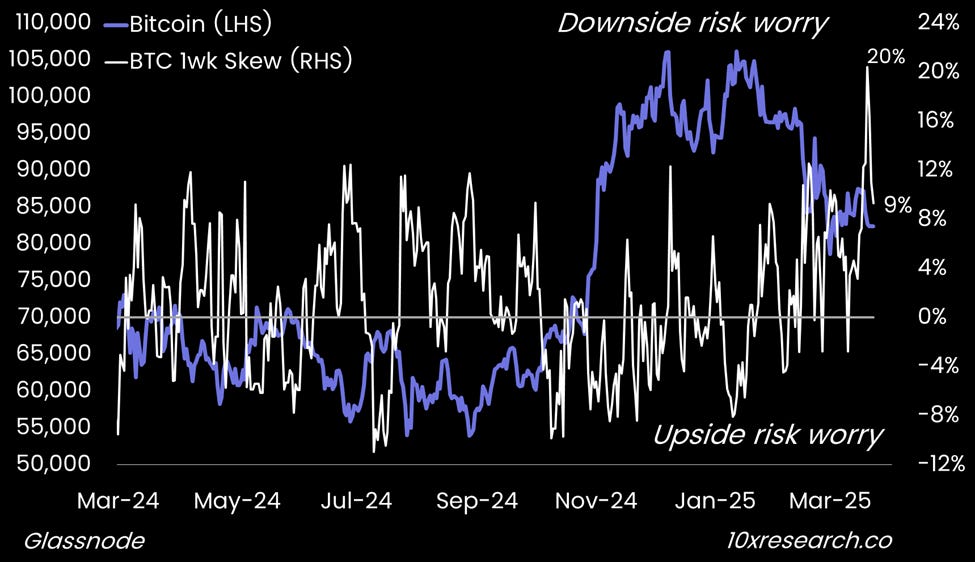

Bitcoin (LHS) vs. 1-week BTC Skew [put-call implied vol] (LHS)

👇3-14) That anxiety led to heightened expectations of Fed action, culminating in an unusual 50-basis-point emergency rate cut in September. This policy move ignited the Q4 rally, which gained further momentum as Elon Musk began publicly backing Trump in October and accelerated with Trump’s election win in November. But it was the Fed’s decisive rate cut that laid the foundation for the rally.