The Bitcoin/Ethereum Options Market Is Sending a Message Most Investors Are Missing— And How We’re Positioned

Actionable Market Insights

Why this report matters

Most crypto research focuses on what might happen next. That’s useful, until market positioning has already shifted and the opportunity has passed. What consistently separates prepared investors from reactive ones is not price targets or narratives, but a clear understanding of how the market is positioned right now and what that implies for risk, timing, and payoff asymmetry.

Over the past few weeks, the BTC and ETH options markets have quietly changed. These shifts don’t show up in headlines, and they aren’t captured by simple bullish or bearish calls. Yet they materially alter the decision environment, the extent of risk being hedged, the location of volatility sold, and the degree to which future price moves are constrained or asymmetric. This is precisely the type of information that determines whether investors are early, on time, or structurally late.

This report matters because it addresses the question professional investors actually care about: what the market is doing beneath the surface, before price reacts. Rather than offering forecasts, it decodes positioning, volatility pricing, and hedging behavior to clarify where opportunity and risk truly sit today. For allocators and hedge funds, this is not incremental insight; it is the difference between making informed decisions and unknowingly providing liquidity to better-positioned participants.

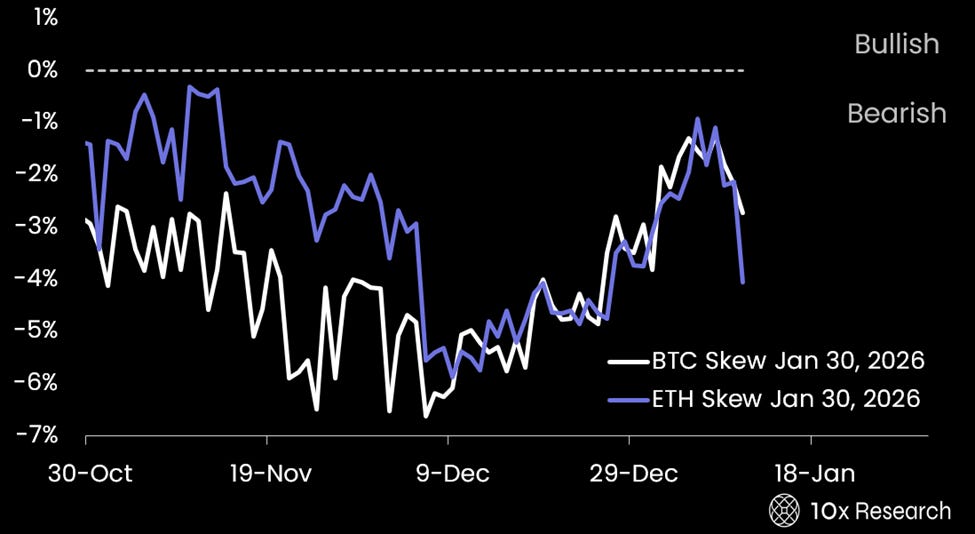

Bitcoin and Ethereum Skew - below we explain how we are positioned